Wall Street Analysts Grow Cautious on Tesla’s Future Performance

Wall Street analysts are taking a more skeptical view of Tesla (NASDAQ: TSLA). After the automaker announced its first-quarter deliveries, Wedbush analyst Daniel Ives characterized the report as a “disaster,” suggesting that CEO Elon Musk needs to “get his act together.” Despite these criticisms, Ives maintains an “outperform” rating with a price target of $550 on the stock.

In contrast, Wells Fargo analyst Colin Langan has taken a harsher stance, issuing an “underweight” rating and a price target of $130. Prior to the deliveries announcement, Langan expected disappointing numbers and forecasted declines in earnings. Following a 13% drop in Q1 deliveries, along with lower pricing, his concerns seem increasingly justified.

Concerns Over Tesla’s Future Growth

Langan remains skeptical about Tesla’s robotaxi ambitions and the efficacy of its current technology. With high expectations surrounding the robotaxi business, he noted that any failure to deploy a paid fleet by June should be viewed negatively. Investors could face disappointment if Tesla cannot meet these targets.

Rare “Sell” Ratings in the Market

Former Morgan Stanley chief U.S. equity strategist Adam Parker recently described Wall Street’s sell-side ratings and price targets as “mostly useless.” His sentiment reflects a common view among professionals who select stocks directly. While sell-side analysts often provide valuable insights and research, they don’t always excel at stock picking, which isn’t always their primary goal.

“Sell” or “underweight” ratings account for only about 6% of analyst ratings, making Langan’s low price target noteworthy. A target significantly below the current stock price is a bold move, setting him apart from most analysts in the field.

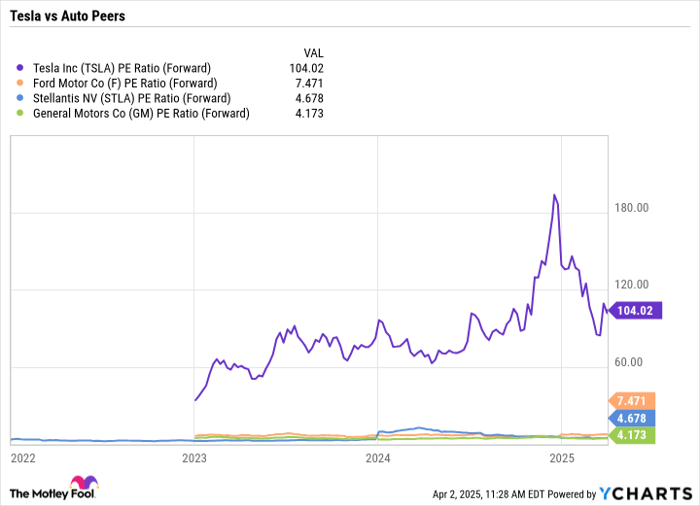

Many optimistic Tesla investors, like Ark Invest’s Cathie Wood, highlight Tesla’s robotaxi venture as a justification for the stock’s high valuation. However, viewed primarily as an automobile manufacturer—particularly one with declining sales—Tesla appears overvalued. The stock boasts a forward price-to-earnings (P/E) ratio exceeding 100 based on estimates for 2025, while its profitable automotive competitors maintain multiples below 8.

Data by YCharts.

Challenges with Autonomous Driving Technology

Tesla lags behind competitors in the robotaxi and autonomous driving sectors. Alphabet‘s Waymo has been providing public autonomous rides since October 2020, with ongoing market expansion. Conversely, Tesla has not fulfilled its autonomous driving pledges, raising concerns about safety and operational reliability.

Unlike its rivals, Tesla does not use lidar technology due to costs, relying instead on a camera-based system that has shown limitations. Reports from last year revealed that the full self-driving (FSD) technology sometimes malfunctioned in adverse weather, leading to dangerous situations. Additionally, AMCI Testing found that Tesla drivers had to intervene over 75 times during 1,000 miles of FSD testing, while the National Highway Traffic Safety Administration (NHTSA) linked Tesla’s FSD and autopilot features to numerous accidents.

Tesla’s FSD program in China has not fared well either. According to reports by Electrek, drivers using the free FSD trial received penalties for various infractions, leading to the trial’s suspension last month.

Image source: Getty Images.

Is Tesla’s Stock Worthholding?

Currently, Tesla’s valuation hinges on becoming a substantial player in the robotaxi market. However, uncertainty surrounds its technology, while competitors like Waymo have already made significant progress.

The company’s automotive sector faces serious challenges, particularly in the Chinese market where competition is fierce. Furthermore, criticism of Musk’s political involvement and the controversial DOGE (Department of Government Efficiency) initiative may be undermining Tesla’s standing in the U.S. and European markets. The brand appears to be suffering damage among a significant portion of potential consumers.

Considering its high valuation, struggling auto performance, and issues with autonomous driving, the potential for Tesla’s stock to decline further cannot be ignored.

Potential Investment Opportunities on the Horizon

Investors often worry about missing out on top-performing stocks. However, there are rare opportunities when analysts recommend companies poised for growth.

For example, notable “Double Down” stock recommendations have produced impressive returns:

- Nvidia: A $1,000 investment in 2009 would now be worth $244,570!

- Apple: A $1,000 investment in 2008 is now valued at $35,715!

- Netflix: A $1,000 investment in 2004 would have grown to $461,558!

Analysts are currently issuing “Double Down” alerts for three outstanding companies, presenting investors with potential opportunities not to be missed.

Continue »

*Stock Advisor returns as of April 5, 2025

Wells Fargo is an advertising partner of Motley Fool Money. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Geoffrey Seiler has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet and Tesla. The Motley Fool recommends General Motors and Stellantis. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.