The Rapid Rise of AI: What It Means for Big Tech and Investors

Artificial intelligence (AI) is shaking up technology in a big way. The ability of AI to produce text, images, videos, and even code is expected to boost productivity for companies worldwide.

While the AI industry is still emerging, Wall Street predicts it could add between $7 trillion and $200 trillion to the global economy in the next ten years. This has led major technology companies to fiercely compete for leadership in AI, investing heavily in data centers and chips.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

According to an analysis from investment bank Morgan Stanley, four major tech players are expected to invest a total of $300 billion in capital expenditures (capex) in 2025. A driving force behind this spending is AI development, particularly with Nvidia (NASDAQ: NVDA) providing the industry’s leading chips. Given this context, Nvidia’s stock could potentially see significant gains.

Current Spending by Tech Giants in AI

To create “smarter” AI applications, developers need to enhance large language models (LLMs), which requires substantial data and high processing power. This is where expenses really add up.

Many companies, aside from wealthy AI startups like OpenAI and Anthropic, cannot afford to build their own data centers. Instead, they depend on tech giants that are investing in centralized infrastructure to rent computing power.

Here’s a look at the spending commitments some leading tech companies are making toward capex, which includes AI infrastructure:

Chips represent a large portion of this spending. In 2023, Nvidia’s H100 graphics processing units (GPUs) dominated the AI market with a staggering 98% market share. These GPUs remain in high demand, and the recent launch of Nvidia’s new Blackwell GPUs promises even greater performance.

Image source: Getty Images.

Morgan Stanley Predicts Strong Growth in 2025

Morgan Stanley forecasts that Amazon, Microsoft, Alphabet, and Meta Platforms will collectively spend about $300 billion on capex in 2025. Their predictions include:

- Amazon: $96.4 billion

- Microsoft: $89.9 billion

- Alphabet: $62.6 billion

- Meta Platforms: $52.3 billion

These estimates indicate significant growth compared to their expected expenditures in 2024. While it’s unclear how much of this spending will be directed specifically toward chips, Morgan Stanley suggested Nvidia could distribute up to 800,000 units of its new Blackwell-based GB200 GPU in the first quarter of 2025.

Pricing for the GB200 GPUs ranges from $60,000 to $100,000 (as reported by Forbes), potentially translating to up to $64 billion in revenue within that timeframe, assuming an average cost of $80,000 per GPU.

Nvidia’s recent quarter brought in $35 billion in total revenue, indicating the possibility of substantial future growth.

Reports reveal that Microsoft is already the top purchaser of GB200 GPUs, and Oracle intends to create a supercluster built on more than 131,000 of these units. The GB200 NVL72 system’s AI inference performance is said to be 30 times faster than the H100, contributing to a significant demand for these GPUs.

Potential Upside for Nvidia Stock

This surge in spending raises important questions about Nvidia’s stock. Despite a remarkable 700% increase in the last two years, it may still be undervalued.

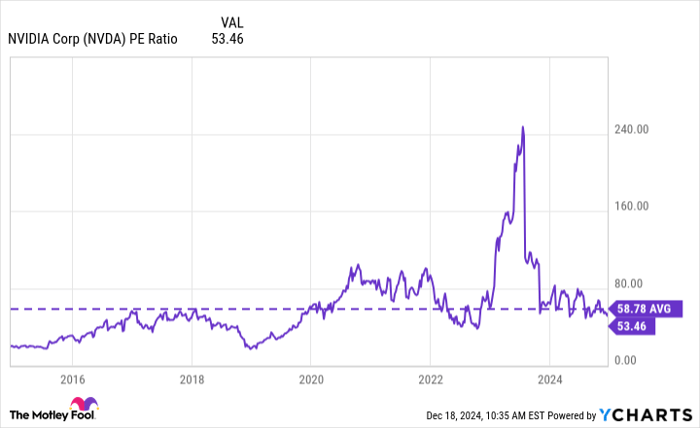

For its fiscal year 2025, Nvidia is projected to achieve $129 billion in revenue and maintains high profitability. The company reported $2.54 in earnings per share (EPS) over the past four quarters, resulting in a price-to-earnings (P/E) ratio of 53.5, which is lower than its 10-year average of 58.8:

Data by YCharts.

Looking ahead, analysts expect the picture to improve. Wall Street’s consensus estimate for Nvidia’s fiscal year 2026 suggests the company could report $4.43 in EPS on $195 billion in revenue.

Under these estimates, Nvidia’s stock trades at a forward P/E ratio of just 30.6. This suggests a substantial price increase is necessary for the stock to align with its historical P/E average of 58.8.

Moreover, Nvidia has a track record of consistently outperforming analyst forecasts.

A Timely Investment Opportunity Awaits

Investors often feel they might have missed the opportunity to invest in lucrative stocks. If that resonates with you, there’s good news.

Occasionally, our team of experts identifies a “Double Down” stock, a company they believe is on the verge of significant growth. If you’re worried about missing your chance, this might be the perfect moment to invest. The historical returns speak volumes:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $349,279!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $48,196!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $490,243!*

At this time, we’re issuing “Double Down” alerts for three promising companies, and opportunities like these may not come around often.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 16, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, Oracle, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.