Primoris Services: Strong Analyst Support Suggests Further Upside

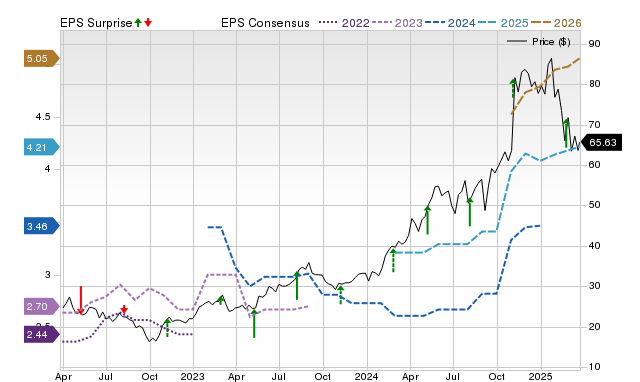

Primoris Services (PRIM) closed at $65.63 in the last trading session, reflecting a 2% gain over the last four weeks. However, short-term price targets set by Wall Street analysts suggest that the stock may have significant room for growth. The mean price target currently stands at $89.43, indicating a potential upside of 36.3% from the current price.

This mean estimate incorporates seven short-term price targets with a standard deviation of $12.62. The lowest price target of $73 represents an 11.2% increase, while the highest forecast predicts a remarkable 67.6% jump to $110. It is crucial to consider the standard deviation here; a smaller figure signals higher agreement among analysts regarding their predictions.

Assessing Price Targets with Caution

Investors often seek the consensus price target as a critical metric, but relying solely on this data can be flawed. The objectivity of analysts in setting these targets has frequently been questioned.

For PRIM, the promising average price target is not the sole indicator of upside potential. Analysts also show confidence in the company’s capacity to outperform previous earnings predictions, further supporting the view of potential stock appreciation. While positive earnings estimate revisions aren’t a direct measure of stock gains, they have historically predicted upward market movements effectively.

Price, Consensus, and Earnings Surprise Insights

Understanding Analysts’ Price Dynamics

Research from various global universities indicates that price targets often mislead rather than direct investors. Studies show that targets set by analysts do not always accurately represent where a stock price is likely to go, regardless of analysts’ agreement levels.

Despite their profound understanding of a company’s fundamentals and the market influences, analysts can tend toward overly optimistic targets. This tendency often arises from the business interests of the firms tied to these stocks, which may inflate projections to stimulate interest.

A tight clustering of price targets marked by a low standard deviation reflects high consensus among analysts regarding the expected stock price direction and magnitude. While this doesn’t guarantee the stock will reach the average price target, it serves as a reliable basis for further exploration of the stock’s fundamental drivers.

In light of this, while price targets merit investor consideration, basing investment decisions solely on them can yield unsatisfactory returns. Thus, maintaining a degree of skepticism toward price targets is prudent.

Positive Momentum and Future Upside for PRIM

Analysts have grown increasingly optimistic about PRIM’s earnings prospects, as evidenced by a consensus in raising EPS estimates. This collective bullish sentiment may offer a valid reason for forecasting stock upswing. Historically, trends in earnings estimate revisions correlate strongly with near-term stock price fluctuations.

Over the past month, the Zacks Consensus Estimate for PRIM’s current year earnings has risen by 0.9%, driven solely by positive revisions, without any downward adjustments.

PRIM holds a Zacks Rank of #2 (Buy), placing it in the top 20% of over 4,000 ranked stocks based on earnings estimate evaluations. This solid ranking, backed by an externally-audited track record, strongly indicates the stock’s potential for near-term upside. You can find the full list of today’s Zacks Rank #1 (Strong Buy) stocks here >>>>

In conclusion, while the consensus price target may not serve as a foolproof indicator of PRIM’s potential gains, the indicated price trajectory can be a meaningful guide for investors.

5 Stocks Set to Double

Each stock was selected by a Zacks expert as a leading candidate to gain +100% or more in 2024. Although not every pick will succeed, past recommendations have achieved increases of +143.0%, +175.9%, +498.3%, and +673.0%.

Many of these stocks fly under Wall Street’s radar, creating excellent entry points for investors.

Discover These 5 Potential Home Runs Today >>

Primoris Services Corporation (PRIM): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.