Understanding Amazon’s Stock Ratings: What Wall Street Analysts Really Think

When it comes to investing, many people pay close attention to recommendations from Wall Street analysts. These ratings can influence decisions on whether to Buy, Sell, or Hold a stock. But how important are these analyst insights in reality?

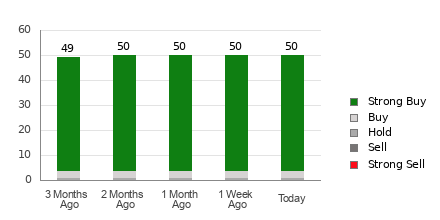

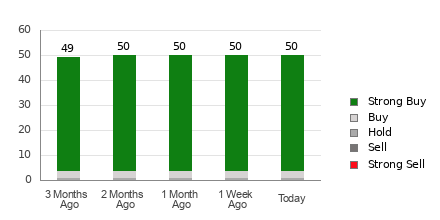

Current Ratings for Amazon

Amazon (AMZN) currently holds an average brokerage recommendation (ABR) of 1.10. This scale ranges from 1 to 5, where 1 is a Strong Buy and 5 is a Strong Sell. The ABR of 1.10 suggests a strong inclination towards buying stock in Amazon.

Among the 50 brokerage firms contributing to this ABR, 46 rate it as a Strong Buy and three as a Buy. This means that a significant 92% of recommendations are strongly positive, and 6% are simply positive.

Trends in Brokerage Recommendations

While this ABR suggests buying Amazon, relying only on these ratings for investment decisions may not be prudent. Research has often indicated that brokerage recommendations do not consistently lead to the best stock performances.

The reasons for this might surprise you. Analysts at brokerage firms sometimes exhibit a bias towards positive ratings due to their companies’ interests. Studies show that for every “Strong Sell,” there are typically five “Strong Buy” recommendations.

Thus, analysts’ interests may not align with those of retail investors. Brokerage recommendations can serve as tools to corroborate your own research, rather than definitive guides to stock performance.

Using Zacks Rank for Better Insights

Zacks Rank offers a different approach. This proprietary rating tool categorizes stocks from #1 (Strong Buy) to #5 (Strong Sell) and shows a solid track record in predicting stock performance. So, comparing the ABR with Zacks Rank can enhance your investment strategy.

Even though both Zacks Rank and ABR use a 1 to 5 scale, they represent different evaluations. The ABR relies solely on analyst ratings, while Zacks Rank incorporates earnings estimate revisions, which can provide a clearer picture of a stock’s potential for growth.

Brokerage analysts often show overly favorable ratings due to conflicts of interest. In contrast, Zacks Rank is influenced by recent changes in earnings estimates, offering updated insights that reflect market realities.

Investment Potential for Amazon

Looking at Amazon’s latest earnings estimate, the Zacks Consensus Estimate for the current year has risen by 1.9% to $5.29 over the past month. Analysts are becoming increasingly optimistic, suggesting that the company’s stock might rise soon.

The surge in consensus estimates, coupled with additional factors reflective of earnings revisions, has earned Amazon a Zacks Rank #2 (Buy). Check out the complete roster of today’s top-rated stocks here.

This positive ABR for Amazon can be a helpful resource for investors making their decisions.

Expert Picks from Zacks

Zacks’ research team has identified five top stocks with the potential for significant gains, with Sheraz Mian highlighting one specific stock expected to excel. This stock belongs to an innovative financial firm that caters to a fast-growing customer base exceeding 50 million.

While not every stock in their picks succeeds, this one is positioned for notable returns, reminiscent of previous high-flyers like Nano-X Imaging, which surged 129.6% in under nine months.

Interested in the latest stock picks from Zacks Investment Research? Download our report featuring the 7 Best Stocks to consider for the next 30 days.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.