The landscape of the energy transition isn’t just limited to electrification. The emergence of a hydrogen-fueled economy is gaining traction, buoyed by significant developments like the U.S. government allocating $7 billion towards seven regional hydrogen hubs in the country last October.

Hydrogen is quickly gaining favor globally, particularly in industries resistant to electrification such as heavy manufacturing and long-haul transportation. As a zero-carbon fuel emitting only water, hydrogen possesses the unique feature of being a baseload fuel that is storable and transportable, unlike solar and wind energy dependent on weather conditions.

One key player navigating the burgeoning hydrogen landscape is equipment provider Chart Industries (NYSE: GTLS). Following a robust earnings report last month, the company has garnered a series of positive developments in March as well.

An Uplift in Debt Ratings and Equity Outlook

Although Chart’s stock performance dropped significantly after its debt-fueled acquisition of peer Howden in late 2022, indications point towards the company now delivering on its revenue and cost synergy promises a year post the acquisition. Last week, ratings agency S&P Global upgraded Chart’s secured debt from “B+” to “BB-” and its unsecured notes from “B” to “B+”.

While the rating altitude may not seem monumental, transitioning from “highly speculative” to “non-investment grade speculative” signifies potential increased demand for Chart’s debt and reduced refinancing costs.

This upgrade also signals a diminishing threat of the debt burden that initially led to the stock decline, thus reducing risk for equity holders. In another boost, analysts at UBS upgraded Chart from “Neutral” to “Buy,” with predictions of generating $600 million in free cash flow this year, chipping away at its debt from $3.7 billion to $3.1 billion by end-2024. This positive outlook hints at a potential doubling or even tripling of Chart’s stock value.

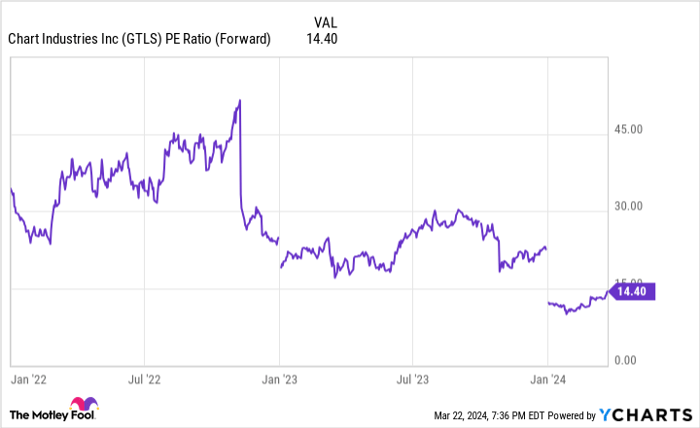

With the possibility of a substantial increase in valuation driven by margin expansion alone, Chart’s stock, halved after the Howden acquisition announcement, could witness remarkable growth. The market’s reevaluation of Chart’s debt load could undo the post-acquisition compression in multiples, presenting significant upside for investors.

GTLS PE Ratio (Forward) data by YCharts

Securing Major Hydrogen Contracts

While historically focused on equipment provision in industries like oil, gas, and traditional industrial gas sectors, Chart is rapidly emerging as a leader in the fast-growing hydrogen economy.

Recent announcements saw Chart securing two significant hydrogen contracts. On March 18, the company landed a substantial hydrogen equipment order from Element Resources Inc. for a large green hydrogen facility in Lancaster, CA. Praising Chart’s in-house design, engineering, and construction of hydrogen equipment, Element underscored the simplicity it brought to the procurement and operation of the plant.

Shortly after, on March 20, Chart unveiled a collaboration with GasLog LNG Services Ltd to explore a global liquid hydrogen supply chain, potentially exporting hydrogen from the Middle East to markets in Europe and Asia.

Though a preliminary step, the collaboration with GasLog, known for its prominence in the global LNG trade, hints at a future sizeable international hydrogen trade market. Chart’s CEO, Jill Evanko, emphasized the momentum shift towards liquid hydrogen supply chains, showcasing the company’s positioning in this evolving landscape.

Image source: Getty Images.

Valuable Potential: Chart’s Growth Trajectory

In its latest earnings guidance, Chart projected adjusted earnings per share between $12 and $14 for the year. Despite recent stock appreciation, trading at $159, the stock is valued at only 11 to 13 times this year’s earnings estimates.

With a potential significant expansion in multiples as debt reduction continues, coupled with an expected growth in the hydrogen market from $16.6 billion to $82.5 billion by the end of the decade, Chart is poised for substantial growth. If the company capitalizes on market opportunities effectively, shareholders stand to benefit from robust earnings expansion and multiple amplification.

Should you invest $1,000 in Chart Industries right now?

Prior to investing in Chart Industries, consider this:

The Motley Fool Stock Advisor analyst team has identified the 10 best stocks they believe can generate significant returns. Chart Industries was not among the selected stocks, which could yield substantial rewards in the foreseeable future.

Stock Advisor offers investors a roadmap for success, featuring portfolio building guidance, regular analyst updates, and bi-monthly stock picks. Since 2002, the Stock Advisor service has outperformed the S&P 500 by over three times*.

Explore the 10 stocks

*Stock Advisor returns as of March 21, 2024

Billy Duberstein holds positions in Chart Industries. His clients may have stakes in the mentioned companies. The Motley Fool holds positions in and endorses Chart Industries and S&P Global. The Motley Fool adheres to a disclosure policy.

The perspectives expressed herein reflect the author’s views and not necessarily those of Nasdaq, Inc.