Many seek to amass riches effortlessly, a modern-day quest for Midas. Investing wisely, however, is the known path to financial opulence. The stock market has minted billionaires, but its treasures don’t yield overnight. Let’s explore standout Nasdaq stocks that bear the potential for substantial returns, a crock of gold awaiting patient hands.

The Ever-Ascending Amazon (AMZN)

Source: Daniel Fung / Shutterstock

Amazon has been ascending to celestial heights, with its stock chirping at a 52-week high. From $149 earlier this year to $180 at present, the momentum is as relentless as the Amazon itself. This e-commerce colossus, besides its retail prowess, has a robust foothold in cloud services and advertising, its cash cows.

The recent quarterly report reveals Amazon’s ironclad balance sheet and a flourishing advertising arm. As the economy convalesces, marketers flocking to Amazon could spell windfalls. Bolstered by investments in artificial intelligence, epitomized by acquiring Anthropic to boost generative AI, Amazon continues to refine the consumer journey.

The Tech Titan Microsoft (MSFT)

Source: Asif Islam / Shutterstock.com

Tech juggernaut Microsoft has solidified its stature as a top-tier tech investment. Famed for its timely wager on OpenAI, it now reaps the dividends of AI integration across its products, augmenting revenues. Microsoft’s cloud services stand as a mighty revenue stream, with AI cybersecurity offerings slated for an April unveiling.

With remarkable liquidity and a semblance of munificence toward shareholders marked by a 0.71% dividend yield, MSFT’s shares, trading at $420, have ascended by 13% year-to-date and an impressive 49% over the span of a year. Microsoft, akin to a familiar sunrise, caters to diverse consumer needs, envisaging a buoyant personal computer market ahead to buoy its ascent.

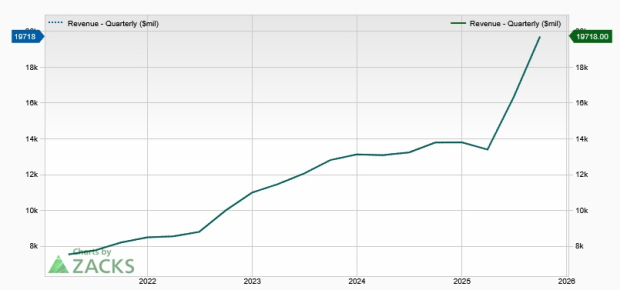

Nvidia, the Visionary Vanguard (NVDA)

Source: Ascannio / Shutterstock.com

If you missed Nvidia’s early glory, the regrets may still echo. One of the creative class paragons, Nvidia (NASDAQ:NVDA) has pioneered rich rewards for ardent believers. Its narrative, a tale of exponential growth and visionary strides, heralds vast potential.

Exploring the Tech Giants: A Strategic Insight

Nvidia – Riding the Wave

Amidst the ebb and flow of the stock market, Nvidia has emerged as a stalwart, redefining the boundaries of growth. Critics speculate a looming decline in Nvidia’s ascension. However, I beg to differ. With the relentless surge in the demand for AI chips and a market teetering on an imbalance, Nvidia seems poised for perpetual expansion.

Launching the “world’s most powerful AI chip” cements Nvidia’s dominance further, propelling revenues to unprecedented altitudes. Valued at an impressive $903, the stock has surged by 87% Year-To-Date and a staggering 234% over the year.

Moreover, Nvidia’s potential transcends mere AI chips. The company has already etched a gold standard in graphics processing units (GPUs) and commands a formidable presence in the gaming realm. Its leadership, penchant for innovation, and strides in the AI domain epitomize its supremacy over rivals, solidifying an almost insurmountable lead in the industry.

Alphabet – A Tech Titan

Source: IgorGolovniov / Shutterstock.com

Having soared to unprecedented heights, Alphabet (NASDAQ:GOOG, NASDAQ:GOOGL) stands tall as one of the “Magnificent Seven” stocks commanding attention. With a rich historical backdrop, a global footprint, and revenue-generating segments like YouTube and Google Search, Alphabet remains a prime stock for investors. The inexorable dominance of Google Search underscores the unparalleled supremacy of Alphabet in the tech domain.

While inflationary pressures tarnished ad revenues momentarily, this setback seems transient. Notably, the flourishing Cloud segment and the innovative Google Gemini platform, which might soon find a patron in Apple (NASDAQ:AAPL) for its future iPhone, forecast a prosperous trajectory for GOOG stock. Priced at $155 presently, Alphabet appears as a bargain, surging by 9% Year-To-Date. Investing in Alphabet transcends mere speculation; it guarantees value for money.

Apple – Ripe for the Picking

Source: askarim / Shutterstock

Pioneers of the iconic iPhones, Apple weathered storms in 2023, witnessing dwindling sales and a subsequent stock dip. Nevertheless, buoyed by speculations around an imminent AI phone, Apple stock holds promise at $171, despite a 7% dip Year-To-Date.

External woes, like fines from the European Commission and plummeting sales in China, led to Apple’s transient setback. Yet, the bedrock of brand loyalty shields the company, ensuring resolute revenue streams. This very loyalty perpetuates as a vital reason to bet on Apple stock, making it a favored Nasdaq selection.

Meta Platforms – Riding the Ad Wave

Source: rafapress / Shutterstock.com

Meta Platforms (NASDAQ:META) steers ahead with a 40% surge Year-To-Date, as advertising revenues recuperate post-slump. Primed as one of the premier revenue generators for the company,

The Rise of Meta: A Tale of Ad Revenue Growth and Market Potential

Meta

Meta, formerly known as Facebook, unveiled impressive financial figures in its recent quarterly report. The tech giant witnessed a remarkable 24% surge in advertising revenue, reaching a staggering $38.7 billion. This remarkable feat exemplifies Meta’s unwavering commitment to dominating the digital advertising landscape.

Positive User Growth

One of Meta’s key strengths lies in its ability to attract and retain users. The company experienced an 8% year-over-year upsurge in daily active users and a 6% increase in monthly active users during the fourth quarter. These figures underscore Meta’s capacity to sustain high user engagement levels, translating into enhanced opportunities for advertisers to connect with their target audience.

Future Outlook

As the global economy shows signs of improvement, Meta is poised to capitalize on the momentum by delivering exceptionally strong ad revenue figures in the upcoming quarters. The company aims to achieve a revenue target of $34.5 billion in the first quarter, signifying a double-digit growth compared to the previous year. Furthermore, Meta’s ambitious plans encompass bolstering its capabilities in artificial intelligence (AI) and the metaverse, setting the stage for future advancements and innovation.

Meta stands as a prominent player in the Nasdaq arena, holding a special place in the hearts of Wall Street enthusiasts.

Visa Inc (V)

Source: Teerasak Ladnongkhun/Shutterstock.com

Visa Inc (NYSE:V) emerges as a beacon of stability in the realm of fintech, captivating investors’ interests as one of the favored Nasdaq stocks. With a widespread global footprint encompassing over 100 million merchants, Visa operates on a business model that ensures consistent revenue generation while maintaining minimal operational costs.

The company’s revenue stream flows steadily as it levies transaction fees each time a Visa card is swiped, a lucrative model bolstered by the presence of over 4 billion Visa cards worldwide. Even in scenarios of elevated inflation, Visa has showcased resilience, with the potential to reach new valuation peaks amidst an uptick in consumer spending.

Trading at $279, V stock has surged by 7% year-to-date, inching closer to the pinnacle of its 52-week high of $290. Visa offers an enticing investment proposition with a favorable risk-reward ratio. The company’s strategic endeavors to broaden its reach extend to Africa, where it has initiated investments through the Africa Fintech Accelerator program, emphasizing early-stage startup empowerment in collaboration with local entities.

Furthermore, Visa presents a dividend yield of 0.75%, enabling investors to harness passive income rewards while participating in the stock’s upward trajectory. It’s no wonder that Visa ranks among the top Nasdaq picks for many seasoned investors.

On the date of publication, Vandita Jadeja did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.