DuPont’s Market Position: Q1 Earnings Beat Amid Continued Challenges

DuPont de Nemours, Inc. (DD), boasting a market capitalization of $29.6 billion, stands as a leader in technology-driven materials, ingredients, and solutions for various sectors, including electronics, transportation, construction, and healthcare. The company operates across the globe, with a presence in the Americas, Asia Pacific, Europe, the Middle East, and Africa, maintaining significant positions in its Electronics & Industrial, Water & Protection, and Corporate & Other segments.

Stock Performance Overview

Despite its strong market presence, DD shares have struggled recently. Over the past 52 weeks, DD has declined 10.5%, in stark contrast to the S&P 500 Index ($SPX), which has gained 12.7% during the same period. In addition, DD has seen a 7.4% decline on a year-to-date (YTD) basis, while the SPX managed a slight YTD gain.

Comparative Sector Performance

Analyzing further, DD has underperformed compared to the Materials Select Sector SPDR Fund’s (XLB) 6.2% drop in the last year. This context highlights the challenges the specialty chemicals maker faces in a fluctuating market.

Q1 Earnings Report

On May 2, shares of DuPont rose by 1.8% following the release of its Q1 2025 earnings report, which showcased an adjusted EPS of $1.03, surpassing estimates. Revenue climbed 4.6% to $3.1 billion, largely propelled by robust sales in the electronics segment, which hit $1.12 billion due to increasing demand for AI-driven semiconductors. Although tariff concerns and stagnant industrial performance linger, the company’s reaffirmed full-year profit outlook of $4.30 to $4.40 per share and progress on its planned electronics business spinoff by November 1 have contributed to a more positive investor sentiment.

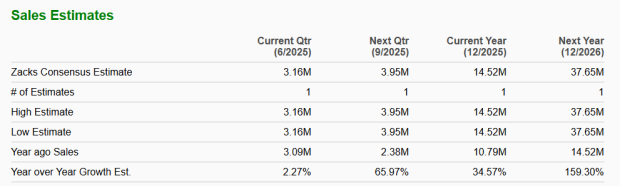

Future Earnings Expectations

For the ongoing fiscal year ending December 2025, analysts project DD’s adjusted EPS to increase by 4.9% year-over-year to $4.27. It’s worth noting that DuPont has consistently beaten consensus estimates over the last four quarters.

Analyst Ratings

Among the 16 analysts covering DD, the consensus rating suggests a “Strong Buy,” supported by 11 “Strong Buy” ratings, one “Moderate Buy,” and four “Holds.” This analysis reflects a slightly more bullish outlook compared to three months ago, when there were only 10 “Strong Buy” ratings.

Price Target Insights

On May 8, RBC Capital analyst Arun Viswanathan reaffirmed a “Buy” rating for DuPont and set a price target of $90. Currently, DD trades below the average price target of $82.20, while the highest target at $100 indicates a potential upside of 41.6% from present levels.

On the date of publication, Sohini Mondal did not hold (either directly or indirectly) any positions in the securities mentioned in this article. All information and data are provided solely for informational purposes. For more details, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of Nasdaq, Inc.