Carrier Global Corporation: A Comprehensive Financial Overview

Carrier Global Corporation (CARR), with a market cap of $60.4 billion, stands as a prominent player in the intelligent climate and energy solutions sector. The company serves a diverse clientele in residential, commercial, and industrial markets, primarily through its Heating, Ventilation, and Air Conditioning (HVAC) and Refrigeration segments. Renowned brands under its umbrella include Carrier, Bryant, Toshiba, and Viessmann.

Recent Stock Performance

Over the past 52 weeks, shares of the Palm Beach Gardens, Florida-based company have slightly underperformed the broader market. Specifically, CARR has risen 8.9%, while the S&P 500 Index ($SPX) has increased by 9.2%. Year-to-date, however, Carrier Global’s shares are up 4.1%, surpassing the S&P’s 3.7% decline.

Comparison with Industry Peers

In a closer analysis, Carrier Global has outpaced the Industrial Select Sector SPDR Fund’s (XLI) 8.5% return during the same period.

Strong Q1 Performance

On May 1, Carrier Global’s shares climbed 11.6% after the company exceeded Q1 2025 adjusted earnings expectations. It reported earnings of $0.65 per share and updated its full-year 2025 profit forecast to between $3.00 and $3.10 per share, exceeding analysts’ average estimates. The rise was fueled by strong demand for HVAC products and aftermarket services, bolstered by increasing global temperatures, energy regulations, and heat pump adoption.

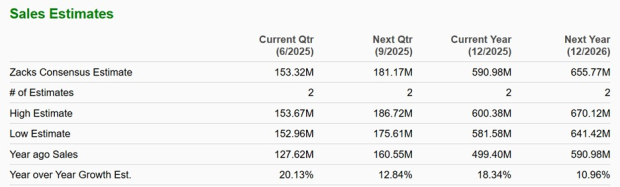

Future Earnings Outlook

For the fiscal year ending December 2025, analysts anticipate that CARR’s EPS will grow nearly 18% year-over-year, reaching $3.02. Notably, the company has surpassed consensus earnings estimates in each of the last four quarters.

Analyst Ratings and Price Targets

Among 22 analysts covering the stock, the consensus rating is a “Moderate Buy,” consisting of 13 “Strong Buy” ratings, one “Moderate Buy,” and eight “Holds.” This outlook is more optimistic than three months prior, when there were only 10 “Strong Buy” ratings on the stock.

On May 5, Wells Fargo analyst Joseph O’Dea increased Carrier Global’s price target to $75 while retaining an “Equal Weight” rating. The adjustment was based on strong CSA margins and steady Residential and Commercial revenue, although O’Dea also noted risks associated with weakening demand in the CSA Residential segment and pressures in the EU Residential market.

Currently, CARR is trading below the average price target of $78.21, with the highest target set at $94, indicating a potential upside of 32.4% from current price levels.

On the date of publication, Sohini Mondal did not hold positions in any of the securities mentioned in this article. All information and data in this article are provided for informational purposes only. For further details, please review the Barchart Disclosure Policy here.

The views and opinions expressed herein are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.