“`html

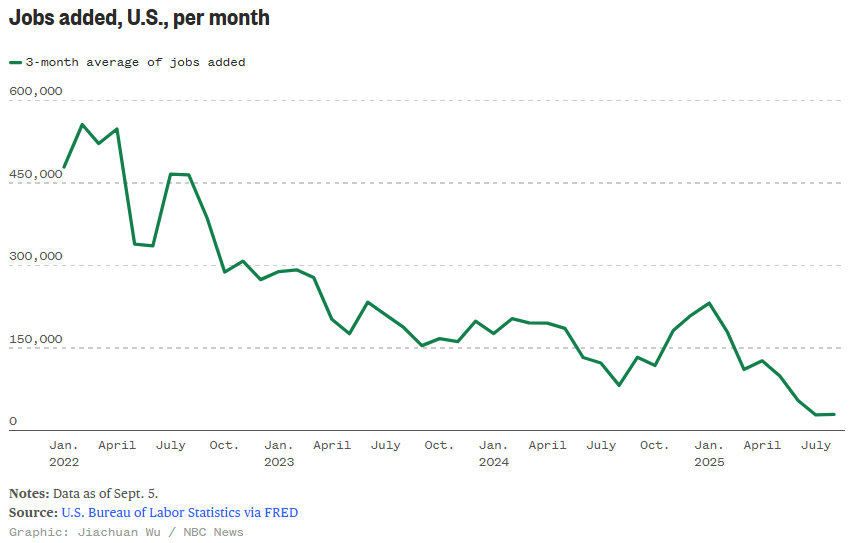

The U.S. economy added just 22,000 jobs in August 2023, significantly below Wall Street’s expectation of 75,000 and marking the weakest labor growth since the COVID-19 crash. The unemployment rate rose to 4.3%, the highest level since 2021, and wage growth dipped from 3.9% to 3.7%.

Moreover, the Federal Reserve is now expected to implement a quarter-point rate cut later this month, with a 100% likelihood in market pricing. This could lead to a total of six rate cuts by the end of 2026, potentially boosting liquidity in financial markets and stimulating stock market rallies.

This jobs report, while grim, indicates a situation that could lead to positive interventions from the Fed without signifying an imminent recession, setting the stage for a favorable investment climate as conditions evolve.

“`