Analysts Weigh In: Tesla Faces Challenges, Apple Shows Promise

Tesla (NASDAQ: TSLA) and Apple (NASDAQ: AAPL) are part of the “Magnificent Seven,” a group of influential U.S. companies that have shaped the Stock market. Although both companies attract interest from investors, Wall Street analysts suggest that Tesla may face downside potential, while Apple has room for growth.

Current Analyst Ratings

- The median target price for Tesla from 57 analysts is $307 per share, indicating a 4% downside from its current price of $320.

- In contrast, 50 analysts have set a median target price of $236 per share for Apple, signaling a 14% upside from its current price of $207.

Analysts clearly favor Apple as a more promising investment over the next year. However, it’s essential for investors to adopt a long-term perspective. Here are the critical insights.

Tesla’s Strategic Opportunities

Tesla’s investment story revolves around major prospects in electric vehicles (EVs), autonomous driving, and humanoid robots. The company has recently lost market share in the EV sector as CEO Elon Musk engaged in political matters. Nevertheless, the introduction of more affordable models later this year could shift the narrative. Musk anticipates reducing his involvement with DOGE by May, which may help the company’s tarnished brand image.

A major development is Tesla’s upcoming launch of its autonomous ride-hailing service in Austin next month, challenging Alphabet‘s Waymo. Tesla can capitalize on its full self-driving (FSD) technology, which relies solely on cameras, unlike Waymo’s more expensive combinations of sensors. Musk has expressed confidence that Tesla could eventually command 99% of the market share.

Additionally, Tesla is leveraging its artificial intelligence (AI) capabilities to develop an autonomous humanoid robot named Optimus. The company plans to deploy thousands of these robots in its factories this year, enhancing operational efficiency. Furthermore, Tesla may start selling Optimus models to third-party businesses in the latter half of next year.

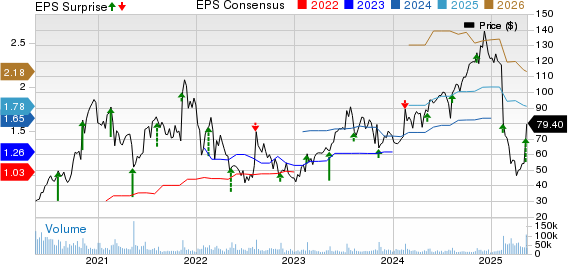

Financial Outlook for Tesla

Wall Street forecasts that Tesla’s adjusted earnings will grow at an annual rate of 15% through 2026. This projection places the current valuation at 140 times earnings, which appears steep. However, this estimate does not fully consider the extensive prospects of autonomous driving and humanoid robots, which may take several years to monetize. For reference, Ark Invest predicts that autonomous ride-sharing could generate $4 trillion in revenue by 2030, while Citigroup estimates that humanoid robots could yield $1.1 trillion in revenue by 2040. These potential growth catalysts may lead to significant earnings acceleration for Tesla in the future.

Apple’s Competitive Edge

Apple’s investment case is grounded in its dominance in the smartphone market. The company has established a strong brand and significant pricing power due to its design acumen in both hardware and software. In the first quarter, the average selling price of the iPhone was more than double that of the average Samsung smartphone. Apple also monetizes its extensive user base through services such as iCloud storage, App Store fees, and Apple Pay.

Moreover, Apple has the opportunity to enter the AI landscape with its Apple Intelligence platform, which automates various everyday tasks. While its current AI offerings have not yet made a significant impact, improvements to Siri, set to be introduced later this year, could change that situation.

Challenges Facing Apple

Two key challenges could impede Apple’s earnings growth. First, although the company has started shifting some iPhone production to India, most high-end models are still manufactured in China, exposing Apple to foreign tariffs. Second, an ongoing antitrust lawsuit involving Alphabet may limit the revenue Apple receives from services that rely on Google Search default placement in its Safari browser.

Apple’s Financial Projections

Wall Street projects that Apple’s earnings will increase at a rate of 6% annually through 2026. At a current valuation of 30 times earnings, this valuation appears elevated. While I believe Apple’s stock is currently overvalued, my view could shift if Apple makes headway in monetizing AI or if tariffs prove less burdensome than expected. For now, I will maintain my distance from the stock.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.