Three Stocks with Potential for Major Gains Amid Market Struggles

This year has been challenging for the Stock market. The broader benchmark, the S&P 500, is down 12% year to date, and it has fallen significantly since reaching highs in February. Meanwhile, the tech-heavy Nasdaq Composite has dropped 18% so far this year. Investors face uncertainty as they navigate President Donald Trump’s ongoing tariffs and trade negotiations, all while assessing the potential impact on the world economy, which is already showing signs of strain.

Where to invest $1,000 right now? Our analyst team recently revealed their picks for the 10 best stocks to buy. Continue »

For investors, it is crucial to look ahead and make use of market sell-offs to buy stocks at attractive prices. According to analysts on Wall Street, here are three stocks that could potentially rally by at least 40% over the next year.

Amazon: Estimated 43% Upside

Amazon (NASDAQ: AMZN), a leader in e-commerce and technology, is not immune to the effects of tariffs. Shares are down 23% this year. Analysts from Wedbush have highlighted that approximately 70% of goods sold on Amazon originate from China, and the ongoing trade dispute could pose challenges. Tariffs of 145% on Chinese imports, imposed by Trump, have prompted a retaliatory 125% tariff from China on U.S. goods, leading to concerns about higher consumer prices and demand.

Despite these headwinds, CEO Andy Jassy informed CNBC that many of Amazon’s third-party sellers may successfully transfer increased costs to consumers. He also mentioned that Amazon has made strategic moves to secure “forward inventory buys” to maintain competitive pricing by negotiating better purchasing terms.

Analysts at Citigroup believe Amazon’s cloud division will remain robust, and improvements in efficiency through automation and regional operations will help sustain profit margins. In a recent three-month period, 46 analysts reviewed Amazon, with 45 recommending a buy and an average price target nearing $260. This suggests a potential upside of about 43% from the current stock price.

Given its current trading multiple of just under 29 times forward earnings, significantly lower than its five-year average of 39.4, Amazon appears well-positioned as a long-term investment. The company’s core e-commerce operations stand on solid ground despite the ongoing pressures on tech stocks.

Bank of America: Potential 39% Gain

Bank of America (NYSE: BAC), the second-largest U.S. bank by assets, has faced a tough year, with its stock down 16%. Initially, bank stocks showed promise as the Trump administration anticipated deregulation that would benefit mergers and acquisitions, along with favorable regulatory capital requirements.

However, the introduction of tariffs has sparked greater concern among economists about the possibility of a recession. An economic slowdown could lead to increased loan losses and diminished growth and activity within investment banking.

Despite these challenges, Bank of America remains a “too big to fail” institution. Its significance in the financial landscape makes a government bailout likely in the event of crisis. Throughout the pandemic, the bank demonstrated its ability to manage through difficult conditions, often taking substantial credit reserves for potential loan losses. Although these reserves impact earnings, they can be adjusted in future quarters if actual loan losses fall short.

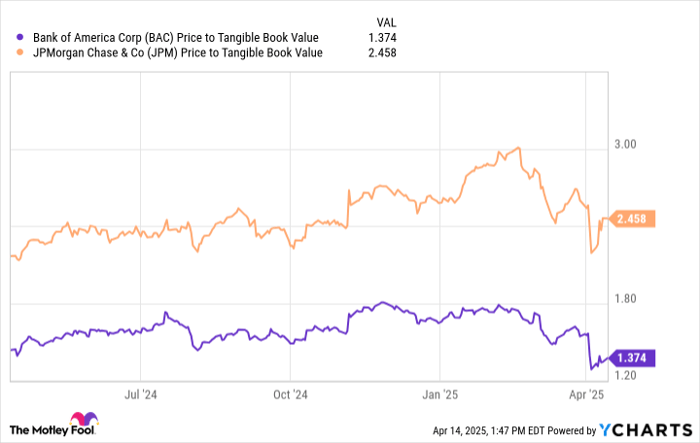

In the last three months, 18 analysts evaluated Bank of America, with TipRanks indicating an average price target of around $51 per share—implying a potential 39% upside as of now. Citigroup analyst Keith Horowitz recently pointed out the significant valuation gap between Bank of America and JPMorgan Chase.

BAC Price to Tangible Book Value data by YCharts.

Bank of America CEO Brian Moynihan has adopted a conservative approach to expanding the bank’s balance sheet since the Great Recession. A widening yield spread between the two-year and ten-year U.S. Treasury bonds could enhance the bank’s profit margins from lending, especially if concerns in the bond market subside.

Typically, Bank of America offers an attractive buy opportunity when trading below 2 times tangible book value. Future rating adjustments could reflect the bank’s resilience during downturns and its capacity to generate consistent returns on equity.

Archer Aviation: 79% Potential Upside

Archer Aviation (NYSE: ACHR) has captured investor interest with the innovative concept of electric air taxis. The company’s electric aircraft can transport four passengers plus a pilot over distances ranging from 20 to 50 miles. These aircraft are designed for quick recharging and reduced noise levels.

Although the idea of commercial air taxis is still in its infancy, Archer has made notable strides toward its realization. The company has achieved important regulatory approvals and completed numerous test flights. In February, Archer announced its plans to manufacture 10 of its Midnight aircraft this year to further enhance testing and partnership programs.

The company is also launching an initiative to distribute its aircraft in several early adopter markets ahead of federal certification by the FAA (Federal Aviation Administration). Archer has designated Abu Dhabi Aviation as its first Launch partner later this year.

In late February, Canaccord Genuity analyst Austin Moeller noted that Archer has opportunities to secure both commercial and government contracts, a move that may propel the company’s future growth.

Archer Aviation’s Growth Potential Shines Amid Market Volatility

Archer Aviation has formed a partnership with Anduril Industries, which engages heavily with the Department of Defense. This collaboration could enhance its growth trajectory in the competitive aerospace sector.

Analyst Insights and Price Targets

In the past three months, seven analysts have published research reports on Archer Aviation, yielding an average price target of $12.83, as reported by TipRanks. This target suggests an approximate 79% upside from its current price.

Despite Archer’s multibillion-dollar market cap, the company has yet to generate revenue. Consequently, its stock may experience greater volatility compared to more established firms like Amazon or Bank of America. Investors should remain aware of this risk as the company navigates its growth path.

The Potential of a First Mover

Archer Aviation’s role as a potential first mover in a new market presents significant upside opportunities. Investors interested in this stock should consider starting with a smaller, speculative position. This allows for gradual accumulation of shares as the company meets its regulatory, operational, and financial milestones.

Assessing Investment in Amazon

Before committing $1,000 to Amazon stock, it’s essential to evaluate other investment opportunities. The Motley Fool Stock Advisor team has identified ten stocks they believe are prime buys right now, with Amazon excluded from this coveted list. These stocks could deliver substantial returns in the years ahead.

For historical context, when Netflix was added to this list on December 17, 2004, an investment of $1,000 would have grown to approximately $524,747!* Similarly, Nvidia, added on April 15, 2005, would have turned a $1,000 investment into around $622,041!*

It’s also notable that the Stock Advisor program boasts an average total return of 792%, significantly outperforming the 153% return of the S&P 500 over the same time frame. Don’t miss the opportunity to check out the latest top stocks available with an Stock Advisor membership.

* Stock Advisor returns as of April 21, 2025

Bank of America, JPMorgan Chase, and Citigroup are advertising partners of Motley Fool Money. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, serves on The Motley Fool’s board of directors. Bram Berkowitz holds no positions in any mentioned stocks. The Motley Fool has investments in and recommends Amazon, Bank of America, and JPMorgan Chase, adhering to a strict disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.