Walmart (NYSE: WMT) has been shaking up the market in recent times. With its recent announcement of a 3-for-1 stock split, it piqued the interest of investors. And now, reports about a potential acquisition of smart TV maker Vizio have further stoked the fires of competition.

However, this move doesn’t seem to be aimed directly at industry leader Roku (NASDAQ: ROKU). Rather, it’s a strategic maneuver to gain an upper hand in the fierce battle for consumer spending against arch-rival, Amazon.

Building Pressure on Walmart

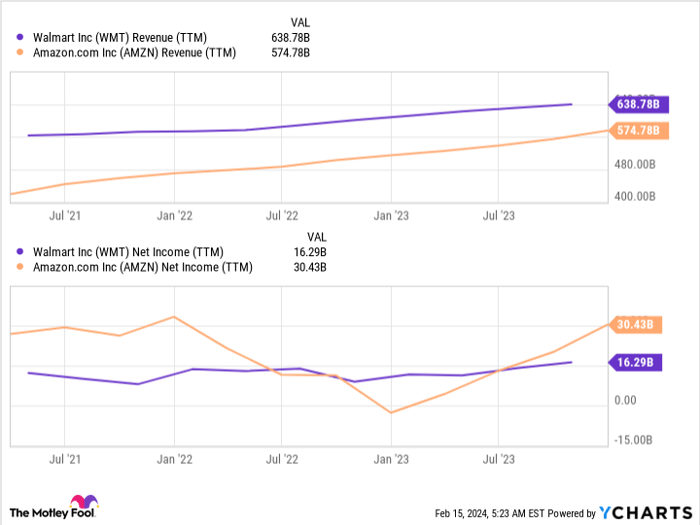

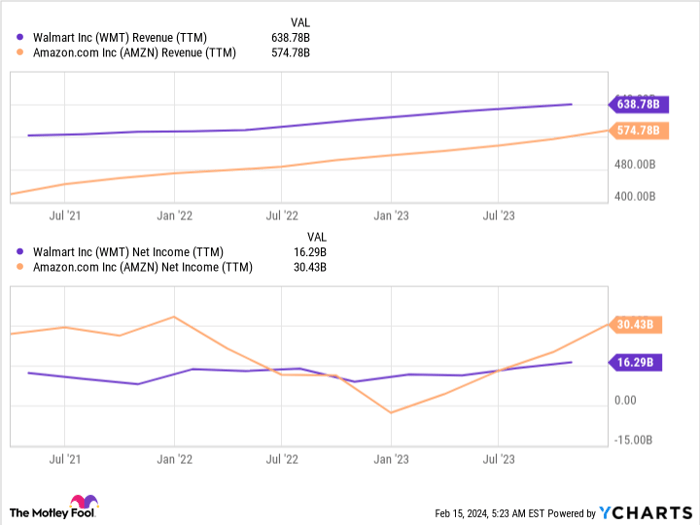

While Walmart still holds the crown for the largest U.S. company by sales, Amazon is nipping at its heels. With Amazon’s revenue surging by 12% year over year in 2023, and Walmart’s trailing at 2.7%, the competitive landscape is becoming increasingly intense. Despite this, Walmart has managed to maintain its lead due to its sheer size, although Amazon’s profitability has surpassed that of Walmart over the past year.

WMT Revenue (TTM) data by YCharts

While both companies fiercely vie for consumer discretionary spending, there are subtle intricacies in their business models. Notably, Amazon boasts a diverse portfolio beyond retail, particularly its formidable Amazon Web Services (AWS) and the recent acquisition of MGM Studios, besides its thriving streaming network. Walmart’s likely aim in acquiring Vizio is geared toward Amazon’s burgeoning advertising segment.

Why Advertising Holds the Key

Amazon’s foray into ad-supported streaming and capitalizing on its e-commerce platform for advertising, leveraging its AI capabilities to target prospective buyers, has proven highly lucrative. Walmart, through the purchase of Vizio, can now prominently feature its products within Vizio’s operating system, a well-matched symbiosis given that Vizio is Walmart’s top-selling TV brand, and Walmart, in turn, is Vizio’s largest customer.

This strategic move also grants Walmart entry into the high-margin third-party ad business, promising to buoy the retail giant’s profits.

Roku’s Standing in the Equation

Roku stands at the helm of the streaming operating system (OS) domain in the U.S., outselling its competitors, including Amazon. With 75.8 million active accounts and 26.7 billion viewing hours, Roku commands a formidable lead over Vizio SmartCast, which lags at 17.9 million active accounts and 5.2 billion viewing hours. According to The Wall Street Journal, Roku’s OS boasts a 25% U.S. market share, surging ahead of Amazon’s 17% and Vizio’s 8%.

While Vizio’s encroachment isn’t a direct threat to Roku, the latter’s stock took a hit upon the news. Investors seem perturbed by Walmart’s brand infiltrating Roku’s territory, despite Roku continuing to hold its own against Amazon.

Effect on Walmart’s Stock

Historically, Walmart has ventured into diverse business domains yet has often been lagging in embracing emerging trends. Its delayed entry into e-commerce, for instance, may have resulted in a loss of market share in the long run. Presently, Walmart commands the second-largest e-commerce market share in the U.S. at 6.4%, trailing far behind Amazon at 37.6%, according to Statista.

While the Vizio acquisition may not dramatically alter Walmart’s fortunes, it signifies a strategic move to stay relevant. Conversely, it is unlikely to significantly impact Roku and instead underscores Roku’s dominance, signaling that it remains the yardstick for competitors.

Should you invest $1,000 in Walmart right now?

Before considering a Walmart stock purchase, it’s worth noting that the Motley Fool Stock Advisor analyst team has identified what they believe are the 10 best stocks to buy now, with Walmart not making the cut. These 10 stocks are projected to yield substantial returns in the coming years.

Stock Advisor offers investors a clear roadmap to success, providing portfolio-building guidance, regular analyst updates, and two new stock picks each month. Since 2002, the Stock Advisor service has delivered over triple the returns of the S&P 500.

See the 10 stocks

*Stock Advisor returns as of February 12, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jennifer Saibil has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Roku, and Walmart. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.