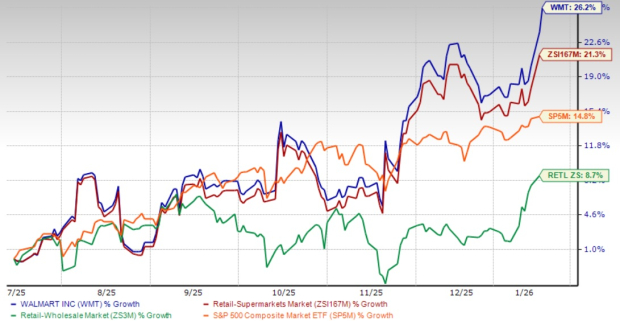

Walmart Inc. (WMT) reached a 52-week high of $120.51 on January 13, 2023, closing at $120.36. Over the past six months, Walmart shares increased by 26.2%, outperforming the retail industry, which grew by 21.3%, and noted gains in the S&P 500 of 14.8%. In contrast, key peers like Kroger, Costco, and Target showed significantly lower performance, with increases of 6.3%, and declines of 2.8% and 14.5%, respectively.

Factors driving Walmart’s strong performance include its emphasis on everyday low prices, enhanced e-commerce capabilities, and investments in technology and automation. The company continues to show resilience in a challenging retail environment, highlighting robust growth in its grocery and general merchandise sectors. Additionally, higher-margin businesses, such as Walmart Connect and membership programs like Sam’s Club, are contributing to earnings stability.

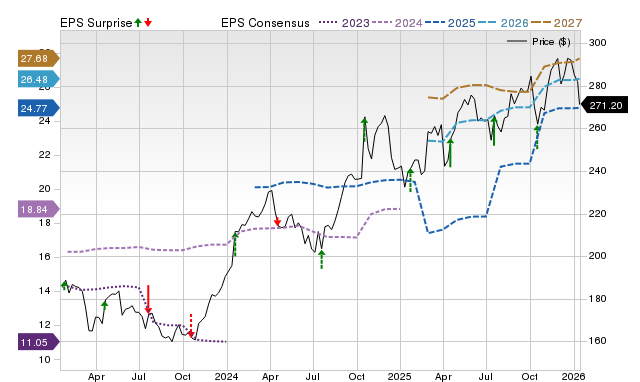

Despite these successes, Walmart faces near-term challenges, including cautious consumer spending and mounting costs due to ongoing investments. The company’s current valuation is at a forward price-to-earnings ratio of 41.02, higher than the industry average of 36.31, suggesting that much of the positive outlook may be priced in. Analysts have recently made modest upward revisions to Walmart’s earnings estimates for fiscal 2026 and 2027, indicative of steady expectations despite mixed market conditions.