Walmart (WMT) reported a 22% increase in global e-commerce sales for the first quarter of fiscal 2026, driven by significant growth in both U.S. (21%) and international (20%) markets. The surge is attributed to enhanced store-based fulfillment methods and a growing customer preference for online shopping. Notably, e-commerce sales at Sam’s Club U.S. rose by 27%, indicating strong demand across all divisions.

As part of its ongoing strategy, Walmart is expanding its supply chain and enhancing digital services, including Walmart GoLocal and Walmart Connect. The company has also made strategic investments, such as acquiring a stake in Flipkart and investing in PhonePe, to bolster its online grocery business.

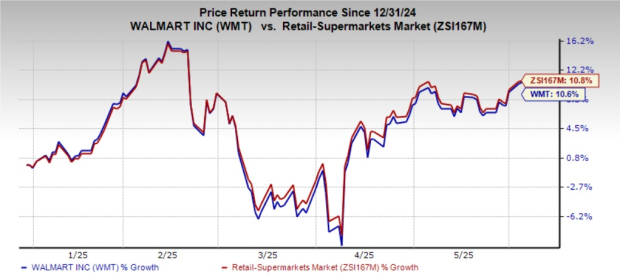

Walmart’s shares have gained approximately 10.6% year-to-date, trading at a forward price-to-earnings ratio of 37.08, above the industry average of 33.95. The Zacks Consensus Estimate predicts year-over-year earnings growth of 3.2% for 2025 and 11.6% for 2026.