Walmart Inc. WMT is widely known for its commitment to keeping pace with evolving consumer patterns and strengthening its omnichannel operations. From investing in pioneering data analytics to expanding its digital presence and optimizing in-store operations, Walmart leaves no stone unturned. The company has unveiled a major milestone — the international expansion of the Walmart Luminate platform.

This expansion will start with Walmex in Mexico, followed by Walmart Canada later in the year. Further, this phased launch will reflect the strategy used in the United States, which will begin with Shopper Behavior and be followed by Channel Performance and Customer Perception. The company is enthusiastic about extending its innovative retail solutions to these new markets, empowering merchants and suppliers with a combined view of the customer and products.

Walmart Data Ventures, a Solid Move

Recognizing the importance of real-time, consistent and adaptable data in generating smarter insights and delivering more personalized services to customers, Walmart initiated a data analytics journey in 2021, namely Walmart Data Ventures. This is a division focused on developing new business applications utilizing Walmart’s robust first-party data. The company aims to improve the customer experience throughout the entire value chain with Walmart Luminate.

Well, the abovementioned expansion of Walmart Luminate takes Walmart Data Ventures a step closer to its goal of establishing itself as a global leader in insights and analytics.

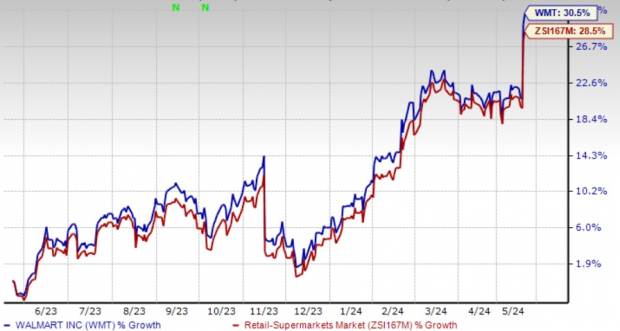

Image Source: Zacks Investment Research

Since the launch of Walmart Luminate, the platform has successfully optimized retail strategies, from product assortment to product development. Presently, 90% of Walmart’s largest suppliers have signed up for a Walmart Luminate Charter subscription, with smaller suppliers representing nearly 50% of total subscriptions.

Growth in Place

Walmart is gaining from its highly diversified business with contributions from various segments, channels and formats. The company continually innovates its services, such as same-day delivery and curbside pickup, to meet the growing demand and ease customers’ experience. By integrating physical stores with online capabilities, the company not only caters to the immediate needs of its customers but also anticipates future trends, positioning itself as a leader in the retail industry’s digital transformation.

This Zacks Rank #3 (Hold) stock has rallied 30.5% in a year compared with the industry’s growth of 28.5%.

3 Solid Retail Picks

The TJX Companies TJX, an off-price retailer, currently carries a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for TJX’s current financial-year sales and earnings suggests respective growth of 3.9% and 9% from the year-ago reported numbers. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The TJX Companies has a trailing four-quarter earnings surprise of around 6.3%, on average.

Tractor Supply TSCO, a rural lifestyle retailer, currently carries a Zacks Rank #2. The Zacks Consensus Estimate for TSCO’s current financial-year sales and earnings indicates respective growth of around 3% and 2.4% from the year-ago reported number.

Tractor Supply has a trailing four-quarter earnings surprise of 2.7%, on average.

Abercrombie & Fitch ANF, a specialty retailer, currently has a Zacks Rank #2. The Zacks Consensus Estimate for ANF’s current financial-year sales and earnings suggests growth of 5.9% and 20.1%, respectively, from the year-ago reported numbers.

Abercrombie & Fitch has a trailing four-quarter earnings surprise of around 715.6%, on average.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

The TJX Companies, Inc. (TJX) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

Tractor Supply Company (TSCO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.