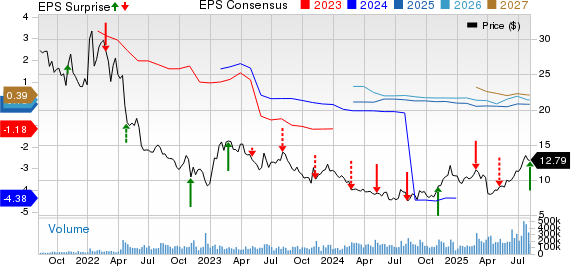

Warner Bros. Discovery reported Q2 2025 earnings of 63 cents per share, exceeding Zacks Consensus Estimate of a loss of 16 cents. This marks a recovery from a $4.07 per share loss in the same quarter last year. The company achieved revenues of $9.81 billion, a 1% increase year-over-year, but slightly missed the estimate by 0.15%.

WBD ended the quarter with 125.7 million global subscribers across its platforms, an increase of 3.4 million from the previous quarter, though domestic average revenue per user fell to $11.16. The adjusted EBITDA reached $2 billion, up 9% from a year earlier. The company aims for 150 million streaming subscribers by the end of 2026 and anticipates approximately $1.3 billion profit from the streaming segment in 2025.

As of June 30, 2025, WBD had gross debt of $35.6 billion with a net leverage of 3.3x. Cash and cash equivalents stood at $4.88 billion, up from $3.89 billion at the end of Q1 2025. The company also reported revenue increases in its streaming segment, up 9% to $2.8 billion, and strong performance in the Studios segment, which saw a 55% revenue increase to $3.8 billion.