Warren Buffett’s Berkshire Hathaway Portfolio Leverages AI

Warren Buffett plans to step down as CEO of Berkshire Hathaway on January 1, 2024, after leading the company to a trillion-dollar valuation over 60 years. An investment of $1,000 in Berkshire stock at the start of his tenure would be worth approximately $50.2 million today, compared to just $398,100 for the same amount in the S&P 500.

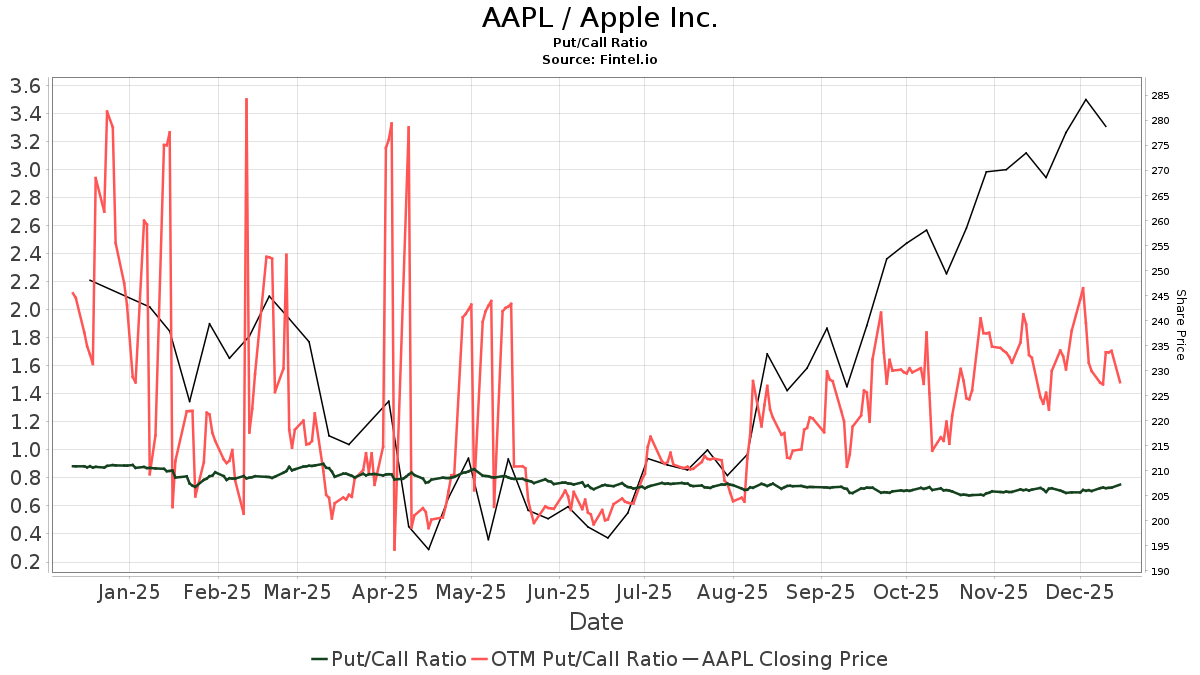

Although Buffett typically avoids chasing market trends like artificial intelligence (AI), several companies in Berkshire’s $317 billion portfolio are integrating AI into their operations. Notably, Amazon (0.7% of the portfolio) is investing $125 billion in infrastructure to meet a $200 billion order backlog. Alphabet (1.7% of the portfolio) is enhancing Google Search and Google Cloud with AI capabilities, contributing to a 62% stock price increase in 2023. Apple remains the largest holding at 20.6%, with its devices optimized for AI, potentially driving future gains as the technology matures.