Key Points

-

Billionaire Warren Buffett is set to retire as the CEO of Berkshire Hathaway in less than two weeks.

-

Berkshire’s $318 billion investment portfolio heavily concentrates in just four stocks, which make up 58% of the total assets.

-

The top four holdings include Apple ($66.3 billion), American Express ($58 billion), Bank of America ($31.3 billion), and Coca-Cola ($28.2 billion).

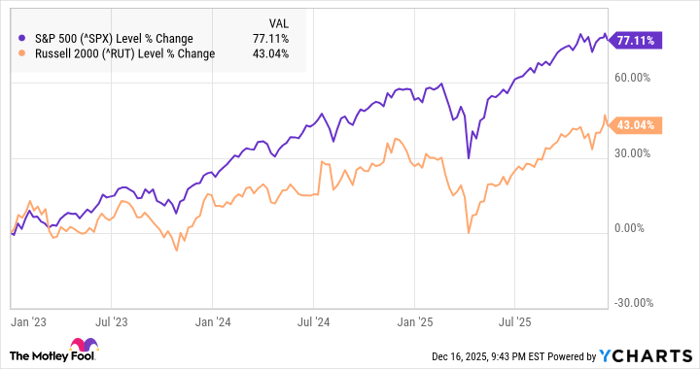

Warren Buffett, the long-time CEO of Berkshire Hathaway (NYSE: BRK.A, BRK.B), will step down from his role in less than two weeks. Under his leadership, the company has amassed a $318 billion investment portfolio focused on a select few large holdings. Notably, just four stocks—Apple, American Express, Bank of America, and Coca-Cola—account for a combined 58% of these assets.

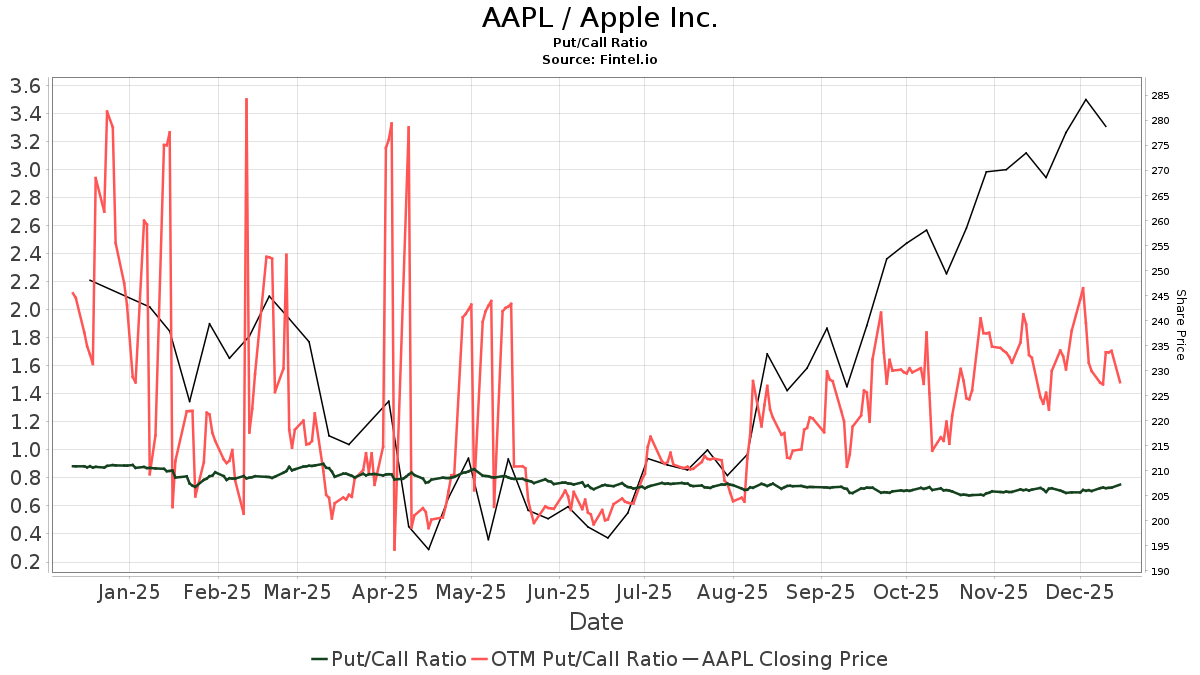

Apple remains the largest position in the portfolio at $66.3 billion, despite Buffett selling 677,347,618 shares since September 30, 2023. American Express follows at $58 billion, while Bank of America and Coca-Cola are valued at $31.3 billion and $28.2 billion, respectively. The concentration and strategic holdings reflect Buffett’s commitment to focusing on companies with solid competitive advantages and capital-return programs.