Warren Buffett’s Success Linked to Charlie Munger’s Investment Wisdom

Warren Buffett credits the late Charlie Munger, his long-time friend and Berkshire Hathaway vice chairman, with greatly influencing his investment philosophy. Munger, whom Buffett referred to as “the architect of Berkshire Hathaway,” introduced him to the value of investing in excellent companies at fair prices rather than merely seeking fair companies at great prices.

The outcomes of this approach are impressive. Since embracing Munger’s advice in 1965, Buffett has delivered a 20% compound annual return to investors while Munger contributed significantly to identifying exceptional businesses over the past 60 years.

Where to invest $1,000 right now? Our analyst team has identified what they believe are the 10 best stocks available today. Learn More »

A notable investment that Munger nudged Buffett to pursue in 2008 was in a company leading the charge in electric vehicle technology and manufacturing. This investment has yielded returns exceeding 2,000% on Buffett’s original stake, and now small investors still have opportunities to participate.

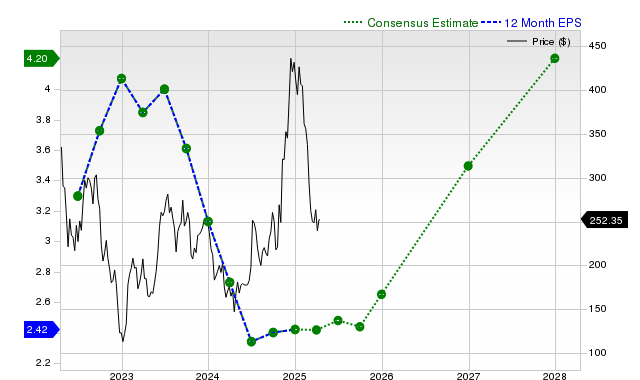

Image source: The Motley Fool.

The Rise of BYD: The Global EV Leader

When Tesla (NASDAQ: TSLA) released its innovative Roadster in 2008, it showcased the potential of electric vehicles. Contrast this with a significant development occurring across the globe, as the Chinese company BYD (OTC: BYDDY) (OTC: BYDD.F) was finalizing its designs for the e6, an affordable compact car.

Clearly, Munger had a preference for BYD. Buffett invested $230 million of Berkshire Hathaway’s funds into acquiring about 10% of BYD. Although Buffett has since reduced his stake, he still retains approximately 4.4%, valued at around $2.4 billion as of now.

Interestingly, BYD began not as an automaker but as a battery manufacturer. The company focused on reducing costs by integrating its production processes, which included manufacturing key machinery internally. This strategy helped BYD attract significant clients, facilitating investments in new technologies that enhanced battery performance and expanded customer base.

After launching its auto division in 2003, BYD integrated its batteries into vehicles from a small manufacturer it acquired. This vertical integration allowed BYD to significantly lower the costs of producing electric vehicles.

Despite launching its first electric car, the e6, BYD struggled initially as its electric vehicle sales negatively impacted its traditional automotive sales. In the late 2010s, the company faced severe financial challenges that nearly led it to bankruptcy.

However, BYD’s dedication to improving technology and reducing manufacturing costs paid off in 2020, leading to impressive sales growth within five years. The introduction of its blade battery in 2020 enhanced safety, range, power, and longevity. Its most popular models are competitively priced at around $20,000 and $12,000, which has contributed significantly to its sales growth.

Analysts predict that BYD’s annual sales of fully electric vehicles will exceed those of Tesla for the first time this year, with Counterpoint Research estimating a market share of 15.7% for BYD compared to Tesla’s 15.3%.

Reasons Why BYD is the Top Electric Vehicle Company

BYD’s commitment to maintaining low costs helped it endure the challenging 2010s and will support its growth going into 2025. The company continues to explore vertical integration opportunities, acquiring lithium mining rights in Brazil earlier this year.

Moreover, BYD has developed a driver-assist system named “God’s Eye,” seeking an SAE Level 4 classification for its top-tier autonomous driving capability, and includes this system standard across all models without additional fees.

This combination of affordability and advanced technology has led to unprecedented unit sales for BYD, as the company reported over 1 million total vehicle sales in the first quarter, including 416,000 battery electric vehicles—up 39% year over year, while Tesla reported 336,000 vehicles sold, reflecting a 13% decline.

As BYD’s sales continue to climb, the company is generating substantial operating earnings. The 2024 operating margin of 7% aligns with Tesla’s, offering ongoing growth potential. Management anticipates first-quarter earnings growth between 85% and 118%, outperforming Tesla’s expected 4% decline.

Currently, BYD Stock trades at approximately 18 times forward earnings estimates, representing an attractive valuation for a rapidly growing company. Though BYD has performed well since Buffett’s investment in 2008, it remains a strong addition to any portfolio today.

Is Investing $1,000 in BYD a Wise Decision?

Before proceeding with an investment in Stock in BYD, it’s important to consider:

The Motley Fool Stock Advisor analyst team has recently identified the 10 best stocks for potential investment, and BYD is not included. The chosen stocks are predicted to yield substantial returns over the years.

For instance, if you invested $1,000 in Netflix on December 17, 2004, you’d now have $495,226!

Similarly, an investment of $1,000 in Nvidia on April 15, 2005, would be worth $679,900 today!

It’s worth noting that Stock Advisor has an average return of 796%—a considerable outperformance compared to 155% for the S&P 500. Don’t miss out on the latest top 10 list available through Stock Advisor.

*Stock Advisor returns as of April 10, 2025

Adam Levy has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway and Tesla. The Motley Fool recommends BYD Company. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.