Berkshire Hathaway’s Cash Strategies Highlighted in Annual Letter

Each year, investors look forward to Berkshire Hathaway‘s (NYSE: BRK.A)(NYSE: BRK.B) annual report. The centerpiece is Warren Buffett’s shareholder letter, where he imparts his insights on investing and the company he leads. This year carries particular significance as Buffett and his investment team have been liquidating assets and increasing cash reserves. Understanding Buffett’s remarks on this cash position is essential for all investors.

Current Actions by Berkshire Hathaway

The major narrative for Berkshire Hathaway in 2024 is centered around an asset many deem unexciting: cash. At the beginning of this year, the company held approximately $168 billion in cash and short-term investments, predominantly U.S. Treasury bills. To put this number in perspective, many companies do not have total market caps that approach this amount.

Wondering where to invest $1,000 now? Our analyst team has identified the 10 best stocks to consider. Learn More »

Image source: The Motley Fool.

By the end of the first quarter, Berkshire’s cash balance surged to nearly $189 billion. It grew to around $277 billion in the second quarter and reached $325 billion in the third quarter. Ultimately, Berkshire Hathaway concluded 2024 with an astounding cash reserve of $334 billion.

In just one year, Buffett effectively doubled the cash position, mainly by divesting shares from the company’s public stock portfolio. Significant sales included shares of prominent companies such as Bank of America (NYSE: BAC) and Apple (NASDAQ: AAPL). While some might speculate that Buffett is preparing for a bear market to find better purchasing opportunities, his insights in the annual shareholder letter offer much to consider regarding the company’s cash reserves.

Berkshire Hathaway’s Unique Investment Approach

Reading Buffett’s entire letter is worthwhile for anyone interested in Berkshire Hathaway. These letters not only entertain but also provide valuable insights. This year, a pivotal quote concerning cash management stood out. Warren Buffett articulated:

Despite what some commentators currently view as an extraordinary cash position at Berkshire, the great majority of your money remains in equities. That preference won’t change. While our ownership in marketable equities moved downward last year from $354 billion to $272 billion, the value of our non-quoted controlled equities increased somewhat and remains far greater than the value of the marketable portfolio.

It’s crucial to interpret Buffett’s perspective on investments. He defines equity investments not just by stocks but also through wholly owned companies. Rather than merely managing a business, Buffett oversees a diverse portfolio of companies, many of which Berkshire town outright.

Understanding Buffett’s Investment Philosophy

This insight offers a fresh perspective on investing in Berkshire Hathaway. When purchasing shares of the company, you effectively partner with Buffett and his management team, similar to hiring a mutual fund manager. Viewing Berkshire Hathaway not solely as a company but as an investment management avenue represents a significant conceptual shift. While the timing for investing in Berkshire Saaathey varies, engaging with a skilled asset manager always holds merit.

Should You Invest $1,000 in Berkshire Hathaway Now?

Before considering an investment in Berkshire Hathaway stocks, it’s advisable to weigh your options:

The Motley Fool Stock Advisor analyst team recommends a current selection of the 10 best stocks to buy, and Berkshire Hathaway is not on that list. The selected stocks are poised for potential substantial returns in the near future.

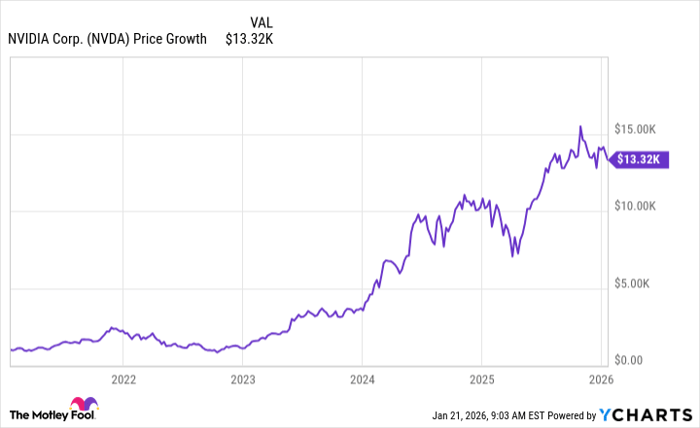

For instance, back on April 15, 2005, when Nvidia was added to this list, a $1,000 investment would have grown to an astonishing $765,576!!

Stock Advisor offers a straightforward strategy for investors, including guidance on portfolio development, regular analyst updates, and two new Stock picks each month. Since 2002, Stock Advisor has outperformed the S&P 500 by more than four times.* Don’t miss your chance to view the latest top 10 list when you subscribe to Stock Advisor.

See the 10 stocks »

*Returns as of February 28, 2025 for Stock Advisor

Bank of America is an advertising partner of Motley Fool Money. Reuben Gregg Brewer holds no position in any of the mentioned stocks. The Motley Fool endorses positions in and recommends Apple, Bank of America, and Berkshire Hathaway. Please refer to the Motley Fool’s disclosure policy for additional details.

The views and opinions expressed herein reflect those of the author and do not necessarily represent those of Nasdaq, Inc.