Core Facts on Berkshire Hathaway’s Recent Moves

Berkshire Hathaway, led by Warren Buffett, continues to hold approximately 21% of its portfolio in Apple, despite trimming its stake by 15% in the third quarter of 2023. This reduction brings its Apple holdings to just over 238 million shares, valued significantly lower than in previous years. Berkshire Hathaway also reported a record-breaking cash pile exceeding $380 billion, fueled by a shift into U.S. Treasury bills, which now account for around $305 billion of its assets.

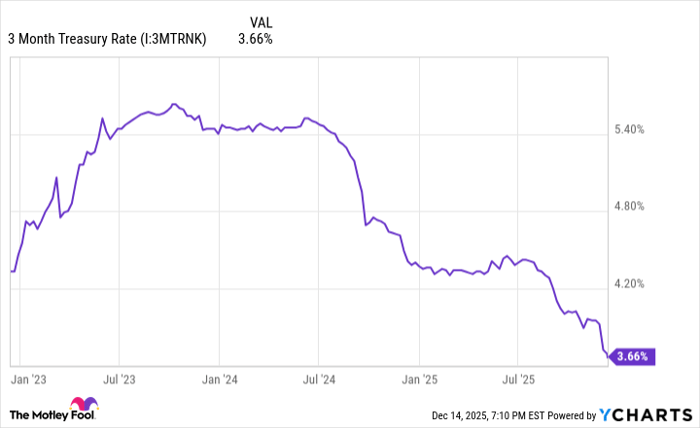

During the quarter, Berkshire Hathaway purchased around $19 billion in T-bills, which offer a yield of approximately 3.66%, translating to annual earnings of about $11 billion. This strategy provides liquidity for potential future investments, as the cash isn’t locked into long-term commitments, allowing the company to capitalize on emerging opportunities promptly.