Berkshire Hathaway’s Q3 Earnings Reveal Major Stock Moves by Warren Buffett

The large conglomerate Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B), led by renowned investor Warren Buffett, released its third-quarter earnings results over the weekend. This report attracts attention from shareholders and market analysts eager to learn about Buffett’s investment decisions during this period, which often reflect his outlook on the market.

Buffett manages a portfolio exceeding $300 billion, focusing on some of the most recognized stocks. Although the 13F report detailing Berkshire’s specific stock holdings at the end of the third quarter will not be available until around November 14, the earnings report gives insights into Buffett’s strategies from the past quarter.

A Significant Sell-off of Apple and Bank of America Shares

How do analysts determine Berkshire’s stock movements without the 13F filing? The company’s earnings reports disclose the fair value of its five largest stock holdings, which play a crucial role in its equities portfolio. By cross-referencing these values with historical stock prices at the end of the quarter, analysts can calculate the volume of shares sold.

As of the end of the second quarter on June 30, the share details were as follows (data is in thousands):

| Stock | Price | Fair Value | Shares |

|---|---|---|---|

| Apple | $210.62 | $84,200,000 | 399,772 |

| Bank of America | $39.77 | $41,100,000 | 1,033,442 |

Source: Berkshire’s second-quarter earnings report/Wisesheets. Chart by author.

Here’s the position Berkshire held for each stock by September 30, calculated similarly:

| Stock | Price | Fair Value | Shares |

|---|---|---|---|

| Apple | $233.00 | $69,900,000 | 300,000 |

| Bank of America | $39.68 | $31,700,000 | 798,891 |

Source: Berkshire’s third-quarter earnings report/Wisesheets. Chart by author.

From these figures, it’s evident that Berkshire reduced its stake in Apple by 25% and in Bank of America by 23%. The exact selling prices will remain unclear until the 13F filing is released.

These moves suggest Buffett and Berkshire view both stocks—and possibly the market—as overvalued. Currently, Apple trades at over 36 times its earnings, nearing the high end of its five-year trading range, while Bank of America stands at about 1.6 times its tangible book value, consistent with its five-year average.

This trend mirrors Buffett’s recent shift away from stocks; throughout the first nine months of the year, Berkshire bought roughly $5.8 billion in stocks but sold over $133 billion.

Historically, the market has only approached its current valuation—based on the Shiller price-to-earnings (P/E) ratio—twice before: just prior to the DotCom bubble and during the pandemic in 2021-2022. Significant market corrections followed both instances.

Investing Heavily in Cash and Treasury Bills

Berkshire’s focus is now primarily on short-term U.S. Treasury bills, signaling a belief that the market is overpriced. The company did not repurchase any of its own stock this quarter, marking the first time since 2018 for this occurrence, and invested only about $1.5 billion in equities.

In the third quarter alone, Berkshire’s investments in short-term Treasury bills surged by over $53 billion. The total now stands at more than $320 billion in cash and cash equivalents. While details of the Treasury bills purchased remain unknown, these bills with maturities of three months or less are included in cash and equivalents, suggesting stable yields.

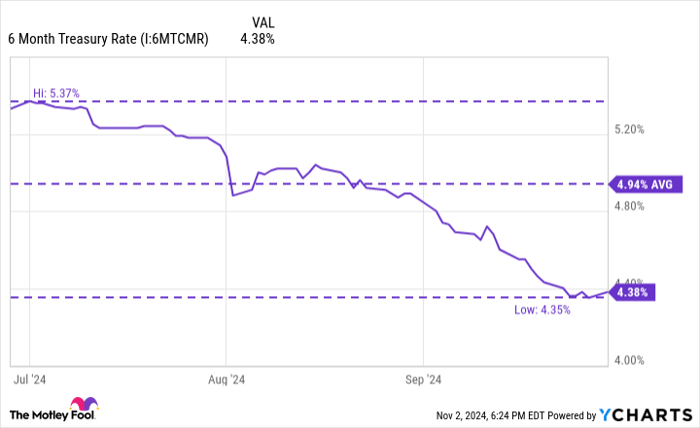

Although the six-month Treasury bill yield dropped in the third quarter, it averaged close to 5%. The timing of Buffett’s purchases remains uncertain, but this serves as a reasonable benchmark for returns.

Insights from billionaire hedge fund manager David Einhorn indicate that Buffett may sense shifting market conditions. Einhorn recently mentioned in a letter to shareholders that Buffett possesses an instinct for market timing and may feel it prudent to step back as market dynamics evolve.

Retail investors need not panic or sell their holdings in Apple or Bank of America. Buffett and Berkshire manage vast portfolios that differ fundamentally from individual investors’ strategies. The stakes are higher for them, given their extensive capital allocation.

Despite this, individual investors should critically evaluate their portfolios. Questions to consider include: Does your portfolio contain stocks valued at high multiples with expected growth that may not materialize? How would your investments hold up in a market correction or recession?

Even if you decide to maintain your current investments, this reflection can enhance your confidence and proficiency as an investor.

Should You Invest $1,000 in Berkshire Hathaway Right Now?

Before proceeding to purchase Berkshire Hathaway stock, take note of this:

The Motley Fool Stock Advisor analyst team has identified their view of the 10 best stocks for investment today, and Berkshire Hathaway does not feature among them. The listed stocks hold potential for significant long-term returns.

For instance, if you had invested $1,000 in Nvidia back on April 15, 2005 when it was first recommended, it would now be valued at approximately $857,383!*

Stock Advisor simplifies investment tracking with guidance on portfolio construction, routine analyst updates, and fresh stock picks every month. Since its inception, the Stock Advisor service has outperformed the S&P 500 more than four times over*.

See the 10 stocks »

*Stock Advisor returns as of November 4, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Bram Berkowitz holds positions in Bank of America, and The Motley Fool has positions in and recommends Apple, Bank of America, and Berkshire Hathaway. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.