Berkshire Hathaway’s Major Miss: A $16 Billion Misstep

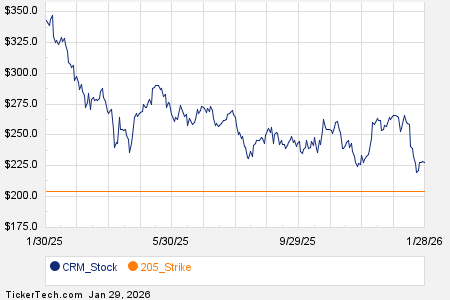

Warren Buffett, now-retired CEO of Berkshire Hathaway, oversaw a staggering cumulative gain of nearly 6,100,000% in the company’s Class A shares under his leadership, contributing to its ascent to a $1 trillion market cap. However, a recent decision to sell a significant stake in Taiwan Semiconductor Manufacturing Company (TSMC) has cost Berkshire approximately $16 billion. Buffett’s investment in TSMC started in Q3 2022 with 60,060,880 shares valued at $4.12 billion, but he sold 86% of this stake by Q4 2022, ultimately exiting the position entirely in Q1 2023.

The Oracle of Omaha’s rapid exit from TSMC came despite the company’s critical role in the AI revolution and growing demand for advanced chips. In hindsight, holding onto the shares could have resulted in a valuation close to $20 billion as of January 26, 2024. Buffett cited concerns about TSMC’s location and potential U.S. export restrictions on AI technology as reasons for his quick exit, suggesting a deviation from his long-term investing philosophy that has historically guided Berkshire Hathaway’s strategy.