Key Points

-

Berkshire Hathaway CEO Warren Buffett will retire from his role at the end of 2023.

-

Buffett has designated eight stocks as “indefinite” holdings, which are expected to remain under the management of incoming CEO Greg Abel.

-

Concerns arise regarding the future of Berkshire’s substantial investment in Apple, which may not align with Abel’s investment strategy.

Warren Buffett, the CEO of Berkshire Hathaway (NYSE: BRK.A, BRK.B), announced his retirement at the company’s annual meeting in May 2023, effective at the end of the year. Greg Abel, currently the vice chairman of non-insurance operations, will take over the CEO role. With Berkshire’s investment portfolio valued at approximately $298 billion, significant adjustments may occur after Buffett steps down, but eight stocks have been classified as indefinite holdings that Abel is unlikely to touch, including Coca-Cola (NYSE: KO) and American Express (NYSE: AXP).

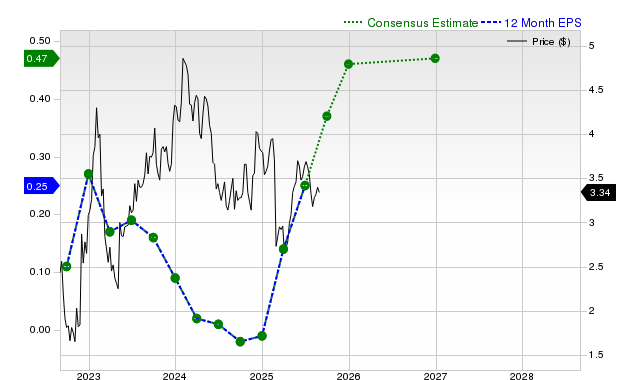

Among Berkshire’s core holdings, there is speculation regarding Apple (NASDAQ: AAPL). Although Buffett has praised Apple for its loyal customer base and robust management, the company’s stalled growth in physical devices and a high price-to-earnings (P/E) ratio may prompt Abel to reconsider the investment. Currently, 21.3% of Berkshire’s invested assets are tied to Apple, and its lack of growth raises concerns about its suitability as a future holding under Abel’s leadership.