Berkshire Hathaway’s Bold Moves: Balancing Value with Growth Stocks

Warren Buffett showcases his signature value investing strategy in Berkshire Hathaway‘s (NYSE: BRK.A)(NYSE: BRK.B) third-quarter transactions. The company recently invested in Domino’s Pizza and Pool Corp., demonstrating a keen eye for solid value opportunities.

Both stocks align with Buffett’s classic investment strategy—established brands with a strong presence in their markets. They cater to different demographics yet are resilient against economic challenges. However, Berkshire’s portfolio includes more than just value stocks; it also features growth stocks that demonstrate solid performance.

Shifting Focus: Growth Amidst Tradition

Among Berkshire Hathaway’s diverse equity portfolio, at least two stocks qualify as growth investments that have outperformed both Berkshire and the S&P 500 over the past year. Let’s explore these options, the reasons behind Buffett’s investments, and whether they might be suitable for your portfolio.

1. Amazon: A Leader in E-commerce and Beyond

Berkshire Hathaway first established a stake in Amazon (NASDAQ: AMZN) in 2019, an era when the company was already transforming industries. Although the exact timing of Buffett’s investment remains unclear, Amazon’s share price has risen 126% over the past five years.

At that time, investors could not foresee the global pandemic looming just months ahead, shifting the business landscape. However, Amazon’s reputation as the top U.S. e-commerce player and a leader in cloud services was already established, positioning it for continued growth. With a strong focus on innovation, Amazon is now venturing into artificial intelligence (AI), enhancing its market position.

Buffett has expressed skepticism around AI; although he recognizes its potential, he admits he lacks thorough understanding. Instead, his investment in Amazon primarily reflects its strong market dominance in pivotal sectors.

Currently, Amazon’s price-to-earnings (P/E) ratio is at 42, near historic lows, indicating good value prospects. The growth potential driven by AI could attract more investors, yet Buffett’s endorsement highlights its stability beyond speculative opportunities.

2. Nu Holdings: Revolutionizing Banking in Latin America

The other notable growth stock within Berkshire Hathaway’s portfolio is Nu Holdings (NYSE: NU). This fintech innovator is making waves in Latin America, offering a range of banking services through a digital platform based in Brazil, with services extending to Mexico and Colombia.

Nu has shown remarkable growth since its 2021 IPO, and Berkshire was quick to become an investor—an atypical move for a firm usually focused on acquiring entire companies or established public firms. The company invested $500 million in a funding round before Nu’s public debut.

CEO David Velez noted that the funding reflected Nu’s strong, sustainable growth trajectory. Before its IPO and achieving profitability, Nu was already the largest fully digital bank globally, boasting 40 million customers. Today, that number has surged to 109.7 million.

Nu is now consistently profitable, reporting positive earnings each quarter since Q3 2022. Though this may not fit the typical Buffett stock mold, it plays a critical role in the financial ecosystem and operates a robust credit business—an aspect more aligned with Buffett’s classic investment principles.

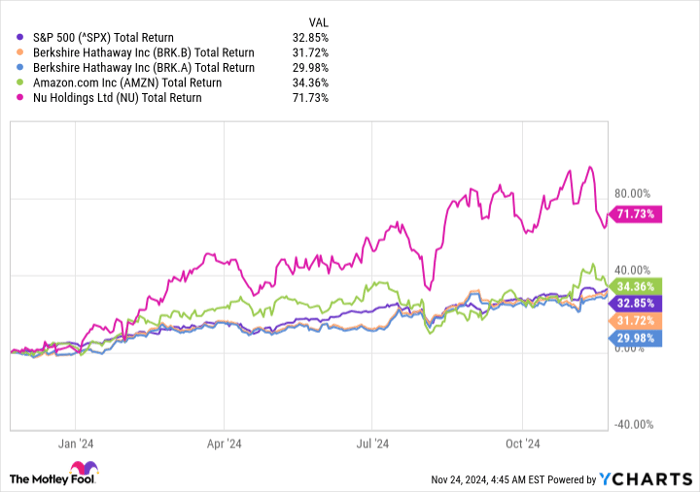

In the past year, both Nu and Amazon have outpaced the S&P 500 and Berkshire Hathaway itself.

^SPX data by YCharts

While Nu exemplifies a high-growth stock, both companies diverge from the typical Buffett style. They thrive on innovation and present significant growth potential, contrasting the slower growth patterns characteristic of Buffett’s traditional value investments.

Is Now the Time to Invest in Amazon?

Before making a purchase decision regarding Amazon stock, it’s vital to consider the following:

The Motley Fool Stock Advisor analyst team recently identified what they believe are the 10 best stocks to buy currently, and Amazon is not included in that list. The selected stocks are projected to yield substantial returns in the near future.

Consider Nvidia, which was on this list in April 2005… if you invested $1,000 based on that recommendation, it would be worth $829,378 today!*

Stock Advisor provides a straightforward strategy for investors, offering portfolio-building guidance, regular analyst updates, and two new stock choices each month. Since 2002, Stock Advisor has significantly outperformed the S&P 500, generating more than four times its return.*

See the 10 stocks »

*Stock Advisor returns as of November 25, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jennifer Saibil has positions in Nu Holdings. The Motley Fool has investments in and recommends Amazon, Berkshire Hathaway, and Domino’s Pizza, as well as recommending Nu Holdings. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.