Berkshire Hathaway’s Warren Buffett: Unveiling His True Investment Favorite

Few money managers can captivate investors like Berkshire Hathaway‘s (NYSE: BRK.A)(NYSE: BRK.B) Warren Buffett. Since he took the reins in the mid-1960s, Buffett, known as the “Oracle of Omaha,” has delivered an astonishing cumulative return of 6,444,825% on his company’s Class A shares (BRK.A). Over the past sixty years, this performance is nearly double that of the benchmark S&P 500 (SNPINDEX: ^GSPC).

Because of this remarkable success, both professional and retail investors are eager to emulate Buffett’s investment strategies. His talent for identifying exceptional bargains is widely recognized and frequently leveraged by his followers.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Berkshire Hathaway CEO Warren Buffett. Image source: The Motley Fool.

Understanding Berkshire Hathaway’s 13F Filings

Investors tend to find it straightforward to track Warren Buffett’s trading activity through his filings. Within 45 days after each quarter ends, Berkshire Hathaway must submit a Form 13F to the SEC, outlining all the stocks that Buffett and his key advisors, Ted Weschler and Todd Combs, bought or sold during that period.

However, it’s crucial to realize that these 13F filings have limitations. They do not fully disclose Buffett’s top pick, a particular stock he has invested nearly $78 billion in over the past seven years, which has outperformed the S&P 500 year-to-date.

Buffett’s Notable Holdings vs. His Preferred Investments

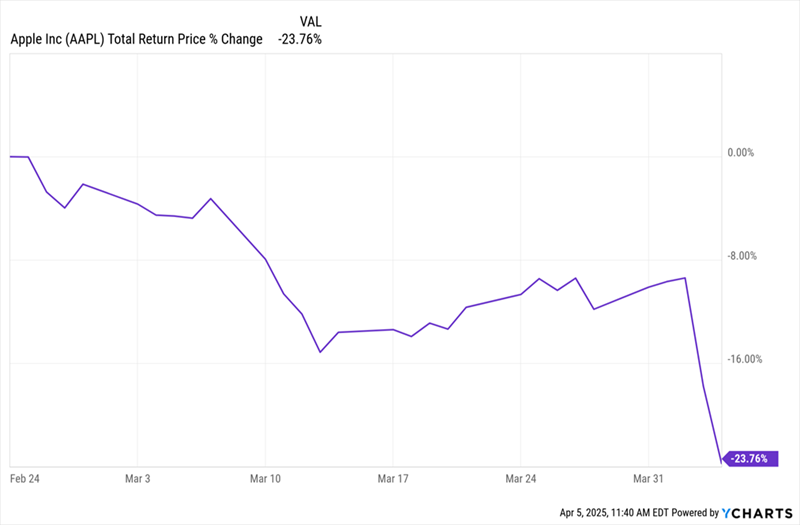

Based on Berkshire’s quarterly 13Fs, one might assume that the top holdings reflect Buffett’s favorite stocks. For instance, Apple (NASDAQ: AAPL) has been Berkshire’s largest holding by market value for over five years. Buffett admires Apple CEO Tim Cook for transitioning the company towards higher-margin subscription services.

Additionally, Apple leads the corporate world in its capital-return program. Since starting share buybacks in 2013, Apple is nearing $750 billion in repurchases, effectively reducing its outstanding shares by almost 43%. This strategy benefits companies producing steady or increasing net income by lifting earnings per share (EPS).

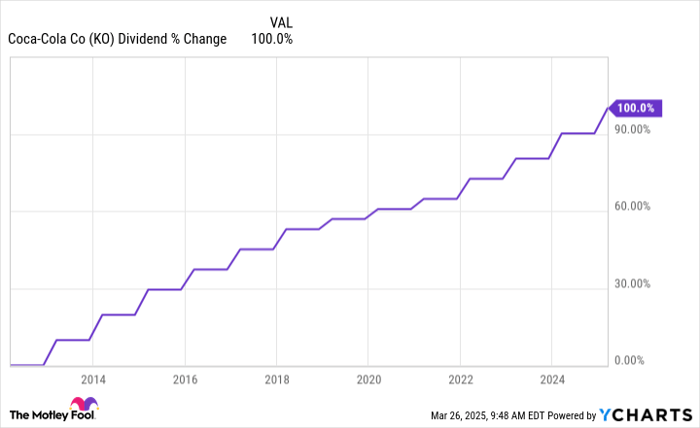

Despite praising Apple and its leadership, Buffett has sold over 615 million shares of Apple since September 30, 2023. Similarly, Buffett’s so-called “forever” holdings, referenced in his 2023 shareholder letter, are often assumed to be his top investment choices. These “forever” stocks include Coca-Cola, whose shares he has held since 1988, and American Express, purchased since 1991, along with Occidental Petroleum and five major Japanese trading houses.

While Coca-Cola and American Express remain core to Berkshire Hathaway’s portfolio, Buffett hasn’t been active in buying more shares of either for quite some time. Even though he has invested nearly $78 billion in his top company, his investments in Occidental Petroleum since early 2022 amount to about 265 million shares, highlighting his consistent focus on his preferred stock.

stock chart.” src=”https://g.foolcdn.com/image/?url=https%3A%2F%2Fg.foolcdn.com%2Feditorial%2Fimages%2F813380%2Fbuy-low-sell-high-stock-market-chart-investing-retirement-getty.jpg&w=700″>

Image source: Getty Images.

Warren Buffett’s Favorite Stock: Berkshire Hathaway

To get a clear picture of Buffett’s top investment, one should go beyond the 13F filings and examine the company’s operational results. The end of each quarterly report reveals how much Buffett has spent acquiring shares of his favorite stock: Berkshire Hathaway itself.

Before July 2018, Berkshire Hathaway’s buyback program restricted Buffett’s ability to repurchase shares unless the stock price fell below 120% of book value. This limitation prevented any repurchases for a long time; however, on July 17, 2018, the board revised the buyback rules, granting Buffett greater flexibility. Now, as long as Berkshire retains at least $30 billion in cash and equivalents, Buffett can purchase shares whenever he believes they’re undervalued.

Since then, Buffett has approved nearly $78 billion in buybacks over 24 quarters (July 2018 – June 2024), reducing Berkshire’s outstanding shares by about 12.6%. These repurchases have, like those of Apple, positively influenced Berkshire Hathaway’s EPS.

As of April 1, 2025, Berkshire Hathaway’s stock has outperformed the S&P 500 by over 21 percentage points year-to-date (17.13% compared to 4.23%). This trend is even more striking over five years, with Berkshire’s Class A shares surpassing the S&P 500 by over 75 percentage points (193.2% versus 117.9%), excluding dividends.

Investors closely monitoring Buffett’s strategies are likely to find valuable insights into the workings of Berkshire Hathaway and its relentless growth potential.

Warren Buffett Takes a Breather on Berkshire Buybacks Amid Market Caution

$78 billion allocated for buybacks may seem wise in hindsight, but it’s notable that Warren Buffett broke his 24-quarter streak by not purchasing any shares of Berkshire Hathaway during the second half of 2024.

BRK.A Price to Book Value data by YCharts.

Buffett’s Value Investing Philosophy Remains Firm

Buffett’s commitment to finding bargains is well known. As a staunch value investor, he approaches even Berkshire Hathaway’s own stock with caution, as it no longer presents a clear buying opportunity.

As of the market close on April 1, Berkshire Hathaway’s stock was trading at a 77% premium relative to its estimated book value for the year ending 2024. Such a significant premium hasn’t been witnessed since the early phases of the Great Recession, dating back to December 2007.

Market Signals and Future Implications

While Berkshire Hathaway has delivered exceptional performance over various time frames, Buffett’s recent hesitance to buy more shares of his own company suggests potential challenges ahead in the market.

Don’t Miss This Second Chance at a Potentially Lucrative Opportunity

Have you ever felt you missed out on purchasing profitable stocks? Now could be your chance to capitalize.

Occasionally, our expert analysts issue a “Double Down” Stock recommendation for firms that they believe are poised for growth. If you think you’ve missed your investment opportunity, this may be the perfect time to act. Here are some impressive returns from past recommendations:

- Nvidia: An investment of $1,000 when we recommended in 2009 would now be worth $286,347!

- Apple: A $1,000 investment from our 2008 recommendation could have grown to $42,448!

- Netflix: If you invested $1,000 when we doubled down in 2004, it would now be $504,518!

We are currently issuing “Double Down” alerts for three remarkable companies, and this might be one of the last chances to jump in.

Continue »

*Stock Advisor returns as of April 1, 2025

American Express is an advertising partner of Motley Fool Money. Sean Williams has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple and Berkshire Hathaway. The Motley Fool also recommends Occidental Petroleum. A disclosure policy applies.

The views expressed here are those of the author and do not necessarily reflect those of Nasdaq, Inc.