Kevin Warsh Nominated as Fed Chair; Market Reactions and Economic Divide Highlighted

On Friday, President Trump nominated former Fed Governor Kevin Warsh to lead the Federal Reserve, raising questions about potential shifts in monetary policy as Jerome Powell’s term concludes in May. Warsh, known for his hawkish views on rate cuts and quantitative easing, has a reputation for credibility that may help preserve confidence in the Fed.

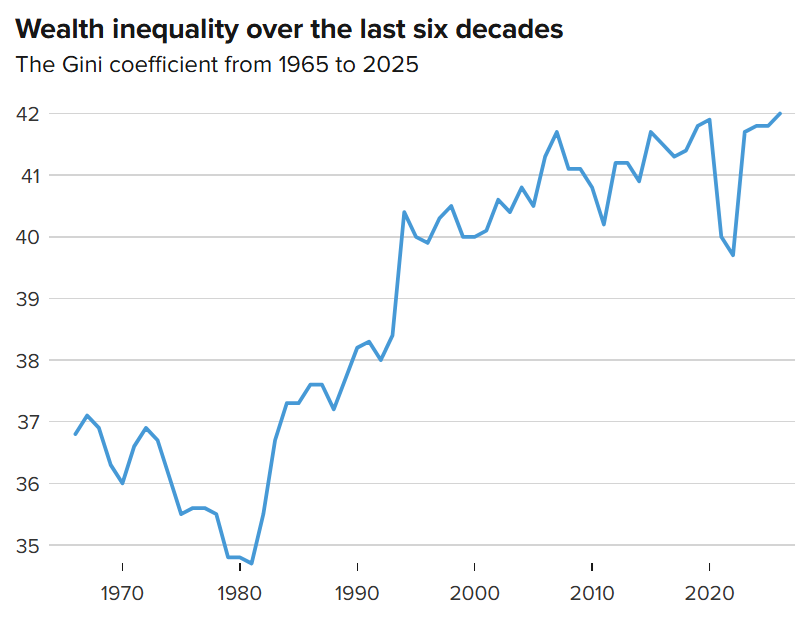

In market reactions following the nomination, significant corrections were observed in precious metals, with gold dropping 10% and silver plummeting 27%. This forced liquidation was partly attributed to fears the Fed may prioritize price stability under Warsh’s leadership, impacting dollar-denominated assets. Additionally, a recent U.S. Bank report indicated that the Gini coefficient, a measure of wealth inequality, is at a 60-year high, highlighting a growing economic divide where the top 1% holds 32% of total wealth while the bottom 50% holds just 2.5%.

These developments suggest a complex economic landscape where investor opportunities may arise, particularly in metals, despite recent bearish trends. As the Fed’s confirmation process for Warsh unfolds, attention will be focused on his policy priorities and their implications for market conditions and wealth distribution.