“`html

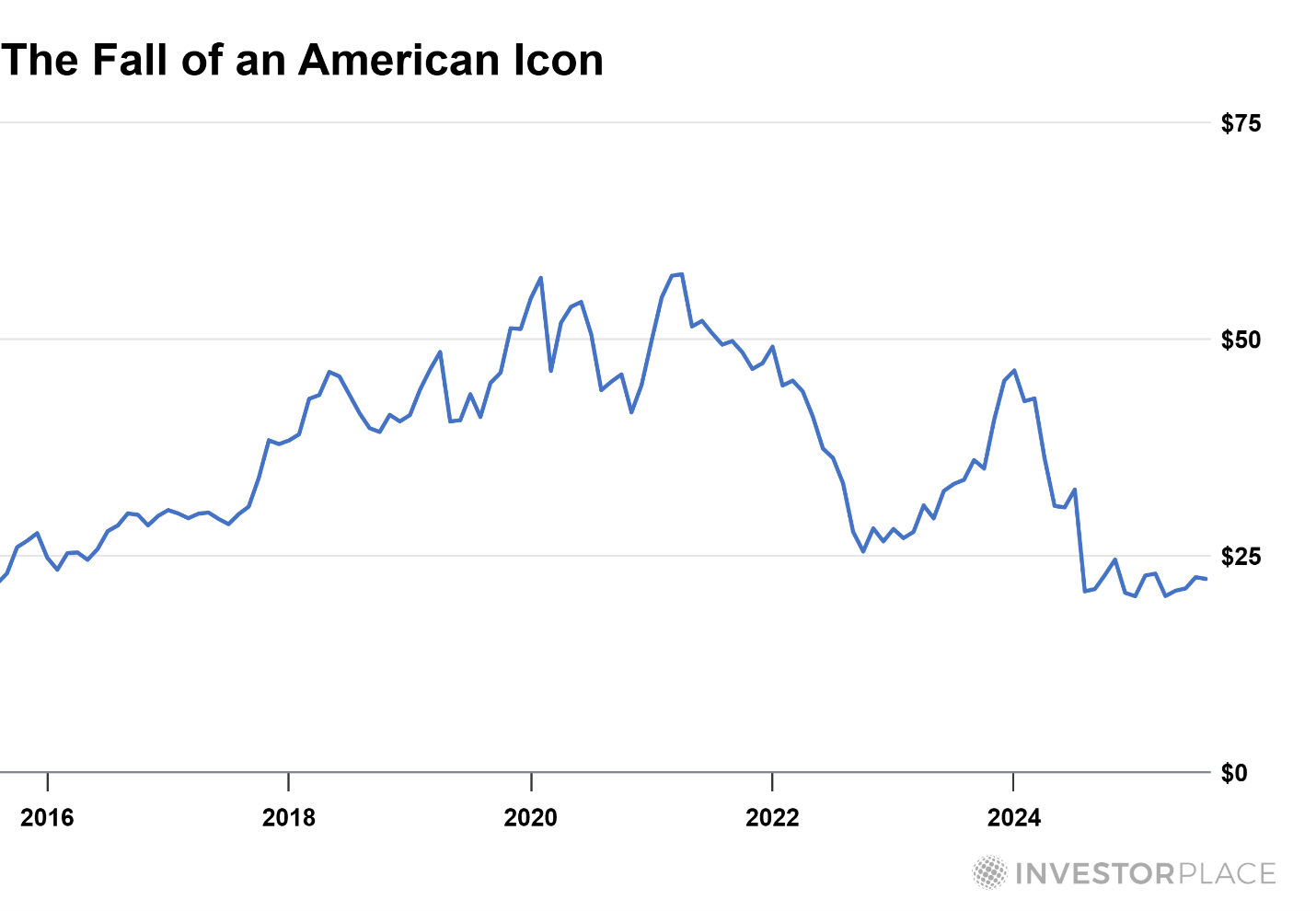

The U.S. government has taken a significant step by investing $8.9 billion to acquire a 10% stake in Intel Corporation (NASDAQ: INTC). This investment comes amidst Intel’s struggles, where the company reported a net loss of $0.13 per share on $53.1 billion in revenue in the previous year, down from a profit of $4.86 per share on $79 billion in revenue in 2021. Despite recent setbacks, analysts predict a slight return to profitability with expected earnings of $0.12 per share on $52 billion in revenue for the current year.

The funds for this investment were sourced from CHIPS Act grants and secure-chip awards. The U.S. government aims to enhance national security by supporting Intel, which remains the only American company capable of producing advanced semiconductor chips at scale domestically. The move is seen as part of a broader effort to reduce dependency on foreign chip manufacturing, especially from Taiwan, a region critical to the global semiconductor supply chain.

This investment by Washington marks a potential shift in industrial policy, indicating a more direct role in strategic industries, with similar stakes previously taken in companies like MP Materials Corp. The Pentagon is also considering equity stakes in defense contractors to ensure national security amid rising geopolitical tensions.

“`