Waste Management, Inc. WM has had an impressive run over the past year. The stock has gained 29%, outperforming the 22.7% and 28.6% growth of the industry it belongs to and the Zacks S&P 500 composite, respectively.

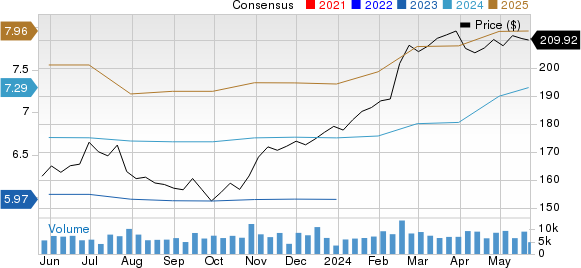

WM has an expected long-term (three to five years) EPS growth rate of 10.6%. WM’s earnings for 2024 and 2025 are expected to grow 17.8% and 9.1%, respectively.

Waste Management, Inc. Price and Consensus

Waste Management, Inc. price-consensus-chart | Waste Management, Inc. Quote

Core Initiatives, Steady Dividends Drive the Stock

Waste Management continues to benefit from increasing environmental concerns, rapid industrialization, increase in population and active government measures to reduce illegal dumping. Its top line increased 5.5% year over year in the first quarter of 2024.

The company’s core operating initiatives target focused differentiation and continuous improvement, and instilling price and cost discipline to achieve better margins. While differentiation through capitalization of extensive assets ensures long-term profitable growth and competitive advantages, cost control, process improvement and enhancements to its digital platform help enhance service quality. WM’s adjusted earnings per share improved 33.6% year over year in the first quarter of 2024.

WM has an expected long-term (three to five years) EPS growth rate of 10.6%. Its earnings for 2024 and 2025 are expected to grow 17.8% and 9.1%, respectively.

WM has a steady dividend, as well as a share repurchase policy. In 2023, 2022 and 2021, the company repurchased shares worth $1.3 billion, $1.5 billion and $1.4 billion, respectively. It paid $1.1 billion, $1.1 billion and $970 million in dividends in 2023, 2022 and 2021, respectively.

Zacks Rank and Stocks to Consider

WM currently carries a Zacks Rank #3 (Hold).

Some top-ranked stocks in the broader Zacks Business Services sector are Western Union WU and Nu NU.

Western Union sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

WU has a long-term earnings growth expectation of 3.9%. It delivered a trailing four-quarter earnings surprise of 15.7%, on average.

Nucurrently has a Zacks Rank of 2 (Buy). It has a long-term earnings growth expectation of 52.4%. NU delivered a trailing four-quarter earnings surprise of 14%, on average.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Nu Holdings Ltd. (NU) : Free Stock Analysis Report

The Western Union Company (WU) : Free Stock Analysis Report

Waste Management, Inc. (WM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.