Enhancing PFAS Testing Solutions

Waters (WAT) is making waves in the Per-and Polyfluoroalkyl Substances (PFAS) testing market with the introduction of Oasis WAX/GCB and GCB/WAX Cartridges. This strategic move comes as the PFAS testing market is projected to soar to $217 million by 2028, backed by a robust CAGR of 14.4% from 2023 to 2028 according to a report by Markets and Markets.

The innovative Oasis WAX/GCB and GCB/WAX Cartridges aim to simplify sample preparation and analysis for PFAS, ensuring meticulous QC testing for low residual PFAS. By utilizing a Weak Anion-Exchange cartridge and dispersive solid phase extraction graphitized carbon black, these cartridges cut down the preparation process by a significant 30 minutes per sample batch while eliminating manual steps – a game-changer in the industry.

These cutting-edge cartridges not only save time but also maintain laboratory cleanliness and deliver high-quality sample preparation products. By removing loose carbon steps, they enhance efficiency and cater to the burgeoning demand for PFAS environmental testing.

Empowering Waters Operating Segment

Waters’ latest move aligns with its ongoing efforts to fortify its Waters Operating Segment. The company recently rolled out the HPLC CONNECT software, a revolutionary platform that seamlessly integrates its high and ultra-performance liquid chromatography (HPLC/UPLC) systems and multi-angle light-scattering instruments (MALS). This all-in-one software platform streamlines operations, minimizes human error, and ensures precise size exclusion chromatography-MALS analyses for intricate biopharmaceutical innovations.

Additionally, Waters joined forces with the University of San Agustin to furnish the institution’s new mass spectrometry imaging center with advanced technologies. The collaboration will equip the MALDI/DESI Mass Spectrometry Imaging Laboratory in the Philippines with Waters’ pinnacle ACQUITY UPLC System and SYNAPT High-Definition Mass Spectrometer technologies, facilitating effective drug discoveries for the treatment of cancer and other infectious diseases.

Moreover, the company unveiled novel bioprocess walk-up solutions aimed at streamlining biologic sample preparation and analysis. By integrating Waters’ BioAccord LC-MS system and Andrew+ robot into its OneLab software, these solutions accelerate upstream bioprocess development by up to six weeks through the updated version of Waters OneLab laboratory automation software.

Optimistic Outlook

These strategic initiatives position Waters to seize growth opportunities within the global LC and MS systems market. Reports indicate that the global LC systems market is set to hit $14.45 billion by 2029, with a robust CAGR of 5.8% from 2023 to 2029. Similarly, the global mass spectrometry market is projected to reach $7.8 billion by 2028, demonstrating a steady CAGR of 7.5% during the 2023-2028 forecast period.

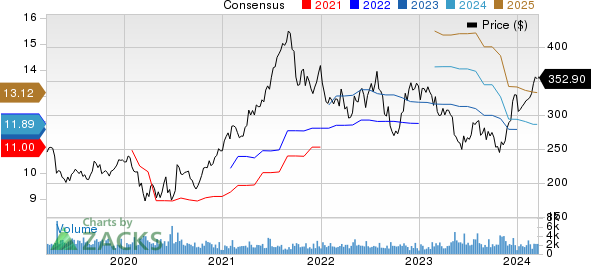

While the company faces challenges in key markets and currency fluctuation concerns, its latest innovations and partnerships are poised to enhance its financial performance. Waters’ shares have shown a 4.3% increase year-to-date, though lagging behind the 7.2% growth in the Medical sector.

Anticipating a decline in total sales for the first quarter of 2024, Waters is gearing up for a competitive market landscape. The Zacks Consensus Estimate predicts a 7.5% decline in sales for the first quarter of 2024 compared to the preceding year.

Investment Considerations

Presently holding a Zacks Rank #3 (Hold), Waters continues to be a stock to watch amidst its industry peers. Investors looking for promising options in the medical sector can explore stocks like DaVita (DVA), Cardinal Health (CAH), and ICON (ICLR). With DaVita boasting a Zacks Rank #1 (Strong Buy) and Cardinal Health and ICON holding a Zacks Rank #2 (Buy), these stocks showcase potential for solid growth.

DaVita, Cardinal Health, and ICON have demonstrated impressive performance year-to-date, with promising long-term earnings growth rates. Staying informed about market trends and stock analyses is crucial for making informed investment decisions in the medical sector.

Infrastructure Stock Boom to Sweep America

A monumental effort to revitalize U.S. infrastructure is on the horizon – a bipartisan and imperative endeavor that promises significant expenditure and wealth creation. The key lies in pinpointing the right stocks early on, maximizing their growth potential during this transformative period.

Unlocking this potential, Zacks offers a special report to guide investors towards five standout companies poised to benefit significantly from the widespread reconstruction and enhancement of America’s infrastructure. This invaluable report is available for free, ensuring investors are poised to capitalize on the upcoming infrastructure wave.