It’s a game-changing day for the world of cryptocurrency as the Securities and Exchange Commission (SEC) has reached a historic decision on the long-anticipated spot Bitcoin Exchange Traded Funds (ETFs).

The approval has set the stage for a major transformation in the digital asset market, creating a gateway for millions of U.S. investors to seamlessly acquire Bitcoin with the ease of a mouse click and the cost structure of an index fund. This milestone has been widely celebrated, with the Bitcoin ETF becoming a top trending topic on Twitter for several consecutive days.

One of the key beneficiaries of this landmark ruling is Grayscale Investments, which has seen its application to convert its approximately $27 billion closed-end Bitcoin fund (OTC:GBTC) into an ETF approved. Other providers, including BlackRock and Ark Invest, have also been given the green light, ensuring a surge of competition in the fund space.

As the ETFs prepare to hit the market, Grayscale’s Bitcoin Trust will redeem shares until it trades at net asset value—marking the final step in liberating billions of dollars previously locked inside the fund.

This development represents a significant win for investors who have weathered through the turbulent journey of GBTC. The road ahead seems to hold promise, but caution is advised amidst the fervor surrounding the ETF approval and the 2024 halving event, as investors need to carefully evaluate their next moves.

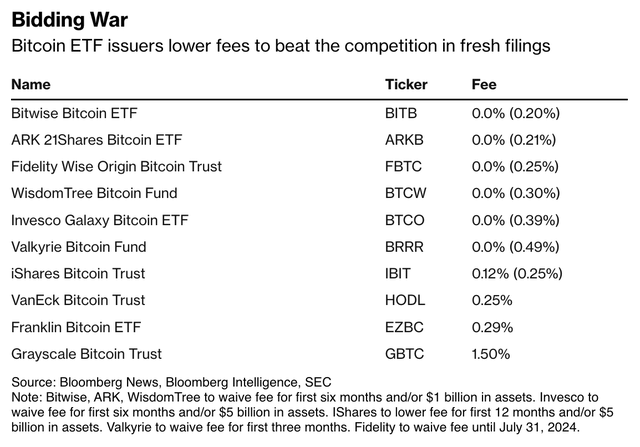

Changing Fee Structures: A Ripple Effect

The SEC’s simultaneous approval of the ETF applications has sparked a fee war among ETF issuers, compelling them to slash fees in a bid to attract assets. This competitive landscape is a significant win for investors considering the latest fee schedules.

Impact of Spot Bitcoin ETFs on the Market

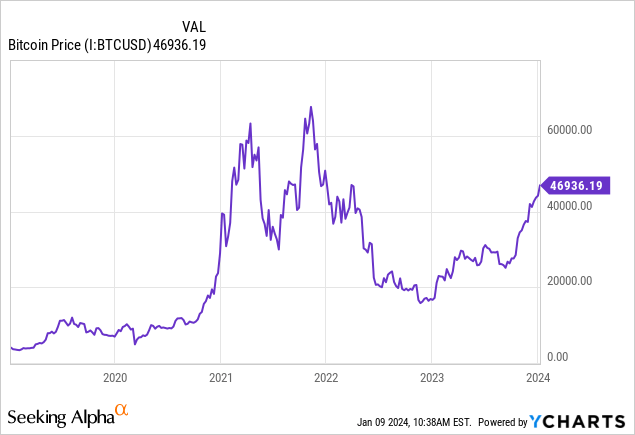

With the arrival of spot Bitcoin ETFs, a surge in demand for Bitcoin is expected. This introduction eliminates barriers that previously curtailed investor interest in Bitcoin, reviving an eagerness to explore this digital asset.

The absence of a spot ETF had long hindered the willingness of investors to engage with Bitcoin, resulting in reduced acquisition or complete abstention due to discomfort with existing options. Now, with the availability of spot ETFs, investors can expect a more favorable avenue to tap into the potential of Bitcoin.

Previously, limited options included platforms like Coinbase (with high transaction fees) or platforms like BlockFi and Celsius, the latter of which experienced a significant collapse. The allure of the Bitcoin Futures ETF (BITO) also waned due to underperforming Bitcoin, likely attributed to structural issues with trading futures for large size. The compelling case for GBTC at the time was overshadowed by the fund’s hefty discount to net asset value and uncompetitive management fees. The iShares Bitcoin Fund (IBIT) and Cathie Wood’s Ark Bitcoin Fund (ARKB) are now positioned as strong contenders with their attractive fee structures.

Moving forward, the influx of hot money prior to the ETF approval is anticipated to trigger waves of profit-taking. This influx was already evident during the significant price swings following the hacking incident involving the SEC’s Twitter account. The delicate balance between supply and demand for Bitcoin will likely dictate price movements, influenced by the limited supply of Bitcoin and its historical correlation to mining activity—an indicative factor that bodes well for the upcoming years.

Looking ahead, while Bitcoin is envisioned to surpass the $100,000 mark over time, the journey towards this target is fraught with unpredictable fluctuations. As the landscape evolves, a strategic approach that involves cashing in GBTC, prudently seizing profits, and adopting a dollar-cost averaging strategy for new investors is recommended.

An allocation strategy for Bitcoin should be driven by individual comfort levels and market values, with modern portfolio theory and prudent risk management principles serving as integral guides. Despite varying market sentiments, including bullish forecasts, a balanced perspective that acknowledges the value proposition of Bitcoin without banking solely on astronomical gains is warranted.

Final Thoughts

The SEC’s decision marks a revolutionary juncture for Bitcoin. The advent of spot Bitcoin ETFs ushers in an era of extensive accessibility for investors, offering a gateway into Bitcoin’s potential as a store of wealth beyond the reach of central bank influence. Whether considering a transition from GBTC to a lower-fee ETF or contemplating an entry into the Bitcoin market, a measured and informed approach is crucial in navigating the evolving landscape of digital assets.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.