Wedbush Initiates Coverage of Rezolute with Strong Buy Potential

Analyst Predictions Point to Significant Growth Ahead

On November 5, 2024, Wedbush kicked off its coverage of Rezolute (NasdaqCM:RZLT) by giving it an Outperform rating.

Analyst Price Forecast Suggests 138.62% Upside

As of October 22, 2024, the average one-year price target for Rezolute stands at $13.00 per share. Predictions for the stock vary, with estimates ranging from a low of $7.07 to a high of $15.75. This average price target signifies a potential increase of 138.62% compared to the most recent closing price of $5.45 per share.

Additionally, Rezolute’s anticipated annual revenue is projected to be $24 million, while the anticipated annual non-GAAP EPS is -0.85.

Fund Sentiment Signals Growing Confidence

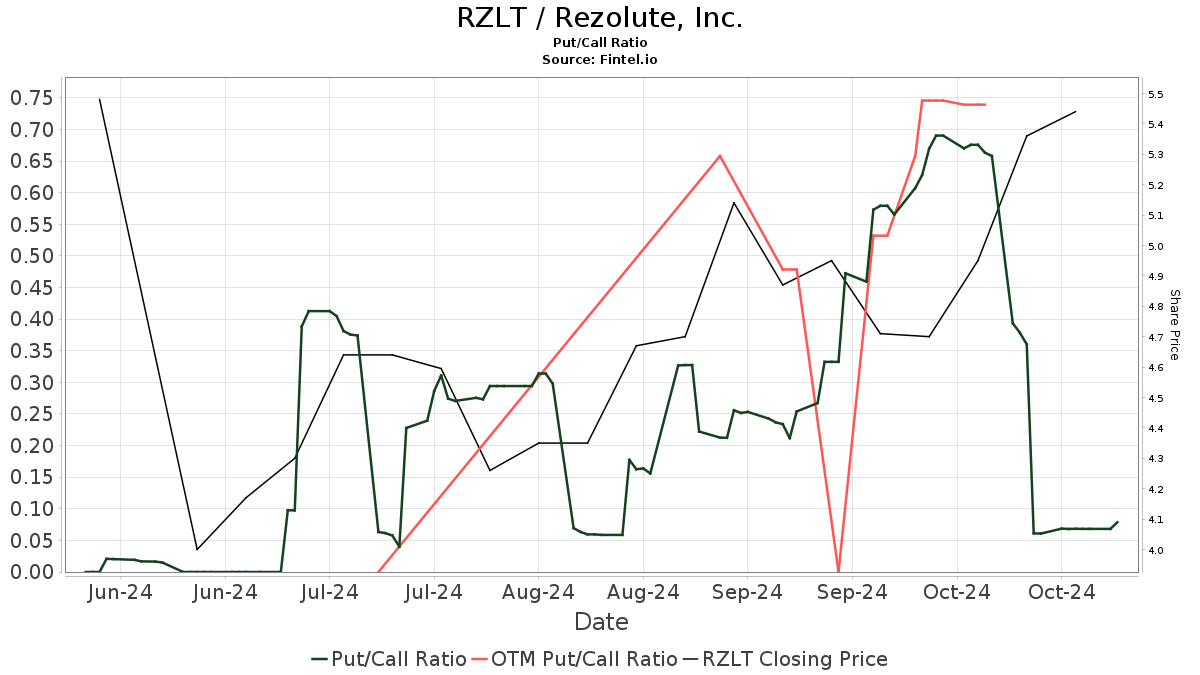

A total of 78 funds or institutions currently have positions in Rezolute, which shows an increase of 23 owners or 41.82% from the last quarter. The average portfolio weight for all funds invested in RZLT is 0.57%, reflecting a 34.42% rise. In the past three months, the total number of shares held by institutions has grown 44.51%, now totaling 39,671,000 shares.  The current put/call ratio for RZLT stands at 0.08, which indicates a bullish outlook among investors.

The current put/call ratio for RZLT stands at 0.08, which indicates a bullish outlook among investors.

Institutional Investors Are Making Moves

Federated Hermes is a significant holder with 11,279,000 shares, representing 20.17% ownership of Rezolute. Their prior filing indicated ownership of 10,154,000 shares, marking an increase of 9.97%. The firm has also upped its portfolio allocation in RZLT by 6.40% over the last quarter.

The KAUAX – Federated Kaufmann Fund Shares own 3,825,000 shares, equating to 6.84% ownership. Previously, this firm owned 3,215,000 shares, meaning they increased their stake by 15.94%. Their portfolio allocation in RZLT surged by 98.66% in the last quarter.

The FKASX – Federated Kaufmann Small Cap Fund Shares holds 3,813,000 shares, representing 6.82% ownership. An uptick from their previous 3,311,000 shares reflects a 13.17% growth, with a portfolio increase of 94.37% also noted.

Nantahala Capital Management owns 2,990,000 shares, or 5.35% of Rezolute. Though they were previously reported to have 3,023,000 shares, this shows a slight decrease of 1.10%. However, they’ve increased their portfolio allocation by an impressive 70.65% in the last quarter.

Vivo Capital owns 2,798,000 shares, or 5.00% of the company, with no changes noted in the last quarter.

About Rezolute

(This description is provided by the company.)

Rezolute is focused on creating targeted therapies to address rare, metabolic, and life-threatening diseases. Its leading clinical product, RZ358, is currently in Phase 2b development to treat congenital hyperinsulinism (CHI), a rare endocrine disorder in children. Additionally, the company’s pipeline includes RZ402, an IND-ready orally available plasma kallikrein inhibitor aimed at treating diabetic macular edema.

Fintel is one of the most comprehensive investing research platforms for individual investors, traders, financial advisors, and small hedge funds.

Our extensive data covers global markets, including fundamentals, analyst reports, ownership details, fund sentiment, options sentiment, insider trading, and more. Our exclusive stock picks are backed by advanced, quantitative models designed to improve profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.