Wedbush Downgrades Airbnb; Institutional Ownership Trends Shift

Fintel reports that on May 2, 2025, Wedbush downgraded its outlook for Airbnb (LSE:0A8C) from Outperform to Neutral.

Current Fund Sentiment Toward Airbnb

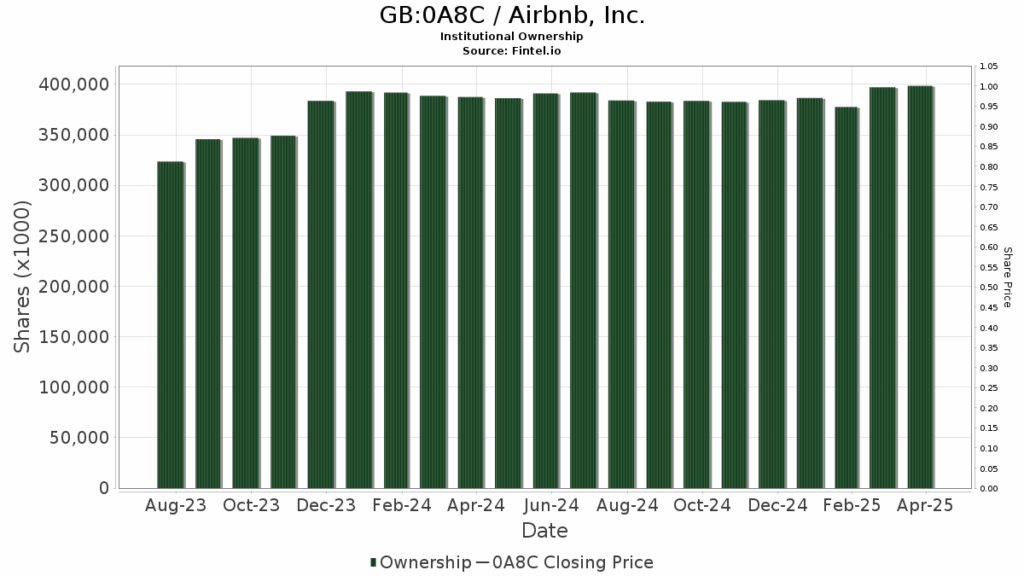

There are currently 2,058 funds and institutions with positions in Airbnb, marking an increase of 101 owners, or 5.16%, in the last quarter. The average portfolio weight dedicated to 0A8C stands at 0.31%, an increase of 1.95%. Over the past three months, total shares owned by institutions rose by 5.88% to 399,724K shares.

Institutional Shareholder Actions

Edgewood Management holds 12,526K shares, representing 2.89% ownership of Airbnb. In its previous filing, the firm reported ownership of 13,582K shares, indicating a decrease of 8.43%. However, it increased its portfolio allocation in 0A8C by 1.72% over the last quarter.

Similarly, VTSMX – Vanguard Total Stock Market Index Fund Investor Shares owns 12,414K shares, equating to 2.87% ownership. In its prior filing, the fund reported 12,549K shares, reflecting a decrease of 1.09%. The firm also increased its portfolio allocation in 0A8C by 1.02% over the last quarter.

Meanwhile, VFINX – Vanguard 500 Index Fund Investor Shares possesses 11,719K shares, making up 2.71% of ownership. In its earlier filing, it reported owning 11,524K shares, which is an increase of 1.66%. However, the firm decreased its portfolio allocation in 0A8C by 0.31% over the past quarter.

Capital World Investors now holds 10,967K shares, representing 2.53% ownership, down from 14,005K shares in its prior filing; this shows a substantial decrease of 27.70%. The firm also cut its portfolio allocation in 0A8C by 20.54% this quarter.

Lastly, Jennison Associates has 10,026K shares, equal to 2.32% ownership. Previously, it owned 10,816K shares, resulting in a decrease of 7.88%. Its portfolio allocation in 0A8C was sharply reduced by 50.13% over the last quarter.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.