Wedbush Downgrades Airbnb Outlook; Institutional Holdings Show Mixed Trends

On May 2, 2025, Wedbush downgraded its rating for Airbnb (WBAG:ABNB) from Outperform to Neutral.

Fund Sentiment Overview

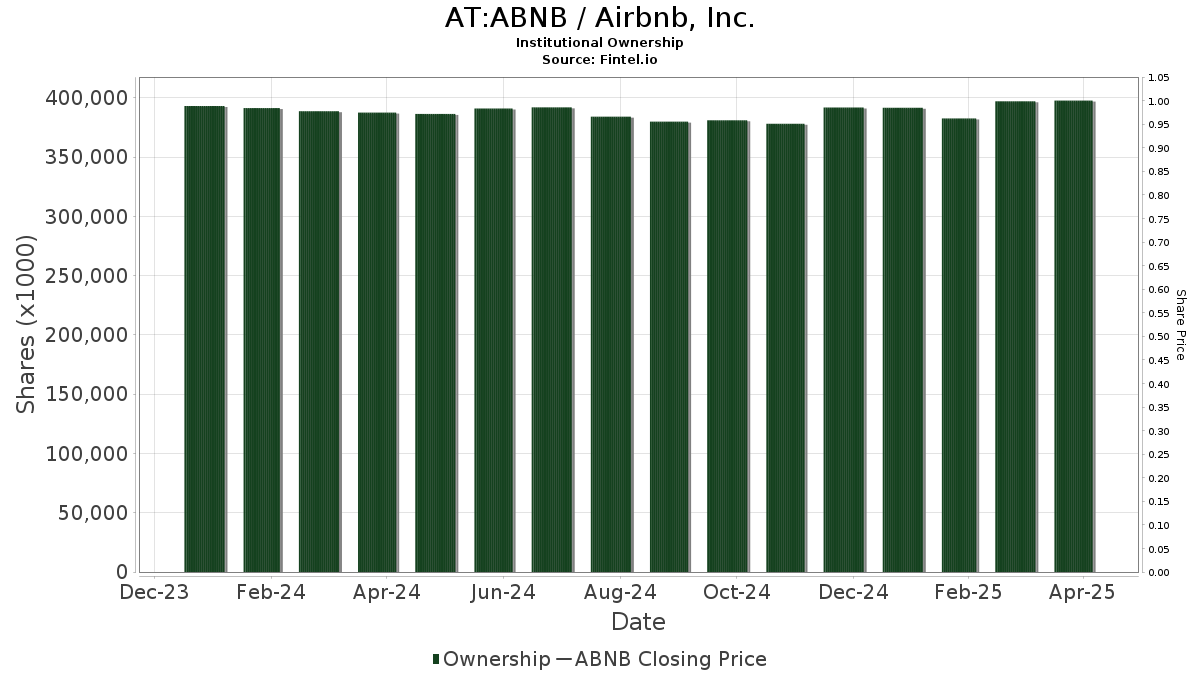

Currently, 2,057 funds and institutions hold positions in Airbnb, marking an increase of 100 owners or 5.11% from the previous quarter. The average portfolio weight for all funds invested in ABNB stands at 0.31%, which is up 1.94%. Over the last three months, total shares owned by institutions rose by 5.87% to 399,691K shares.

Actions by Other Shareholders

Edgewood Management now holds 12,526K shares of Airbnb, signifying 2.89% ownership. This represents a decrease of 8.43% from its previous holding of 13,582K shares. However, Edgewood has increased its portfolio allocation in ABNB by 1.72% during the last quarter.

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) owns 12,414K shares, equating to 2.87% ownership. This is down by 1.09% from the prior quarter’s 12,549K shares. The firm has increased its portfolio allocation in ABNB by 1.02% recently.

Vanguard 500 Index Fund Investor Shares (VFINX) holds 11,719K shares, representing 2.71% ownership and an increase of 1.66% from the earlier 11,524K shares. However, the portfolio allocation in ABNB has decreased by 0.31%.

Capital World Investors holds 10,967K shares, indicating 2.53% ownership, a notable decline of 27.70% from its previous holding of 14,005K shares. This firm has also reduced its ABNB allocation by 20.54% over the last quarter.

Jennison Associates currently owns 10,026K shares, representing 2.32% ownership, down 7.88% from 10,816K shares previously. It has significantly cut its portfolio allocation in ABNB by 50.13% in the last quarter.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.