Riding the Roller Coaster: Energy Market Swings

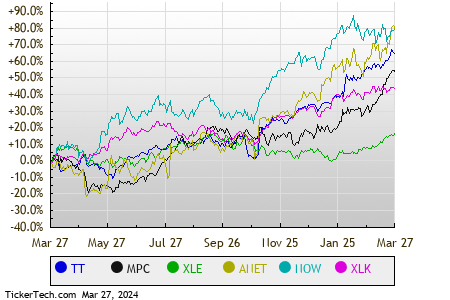

As the market waltzes through another trading day, the Energy sector takes the lead in Wednesday’s performance dance, with a paltry 0.4% uptick. Within this band, Trane Technologies plc (Symbol: TT) and Marathon Petroleum Corp. (Symbol: MPC) flaunt themselves as the day’s sluggish duo, each groaning with a loss of 0.7% and 0.6% respectively. The Energy Select Sector SPDR ETF (Symbol: XLE) toes the line with a 0.5% stumble today, despite a commendable 11.56% dance through the year. Trane Technologies plc and Marathon Petroleum Corp. take center stage with a 22.19% and 32.76% year-to-date performance, respectively. MPC’s 4.4% contribution to the XLE portfolio adds some heft to this sluggish show.

The Tech Tango: A Syncopation of Tech and Communications

Following closely behind in this market Masquerade is the Technology & Communications sector, with a meager 0.5% rise. Among the leading dancers in this group, Arista Networks Inc (Symbol: ANET) and ServiceNow Inc (Symbol: NOW) stumble gracefully with losses of 4.0% and 3.0%, respectively. The Technology Select Sector SPDR ETF (XLK) tries to maintain poised neutrality, flat-footed in midday trading and boasting an 8.03% year-to-date performance. Arista Networks Inc and ServiceNow Inc show off their endurance with a 21.46% and 6.94% year-to-date sprint, jointly commanding 2.4% of the XLK routine.

Comparing the stock and ETF performers across the trailing twelve months lays bare a tapestry of relative price movements, each symbol swaying in a different hue as showcased in the legend at the bottom:

The Trading Tango: Midday Shuffle of S&P 500 Sectors

Casting a glance over the S&P 500 components across sectors bopping through this Wednesday afternoon session reveals a jive of nine sectors shimmying upwards while none falter below:

| Sector | % Change |

|---|---|

| Utilities | +2.0% |

| Materials | +1.2% |

| Consumer Products | +1.1% |

| Financial | +1.1% |

| Healthcare | +1.0% |

| Industrial | +0.9% |

| Services | +0.7% |

| Technology & Communications | +0.5% |

| Energy | +0.4% |

![]() 10 ETFs With Stocks That Insiders Are Buying »

10 ETFs With Stocks That Insiders Are Buying »

Also see:

FEYE Insider Buying

ETFs Holding SYRG

MTUS Stock Predictions

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.