Materials Sector Steers Ahead

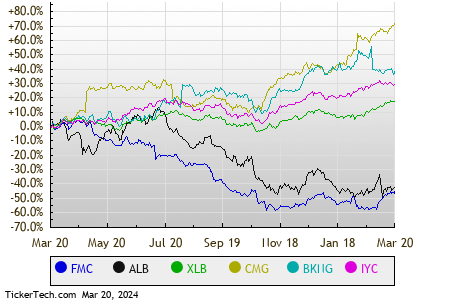

The stock market is a ship navigating the unpredictable waters of the economy. On a midweek noon, the Materials sector stands as a steady captain guiding the ship to a 0.6% increase. FMC Corp. (FMC) and Albemarle Corp. (ALB) are like experienced sailors leading the way, boasting gains of 3.7% and 2.1%, respectively. In the vast sea of exchange-traded funds (ETFs), the Materials Select Sector SPDR ETF (XLB) is a loyal first mate, following closely with a 0.4% gain for the day and an impressive 6.74% gain year-to-date. While FMC Corp. has steered 1.43% up year-to-date, Albemarle Corp. finds itself navigating a -14.50% difference. When combined, the duo makeup approximately 2.2% of the XLB’s holdings.

Industrial Sector Forges Forward

The Industrial sector is a powerful engine propelling the economy. On this Wednesday, it’s up 0.4%, showcasing strength and resilience. Generac Holdings Inc (GNRC) and United Airlines Holdings Inc (UAL) are like locomotives, chugging along with gains of 3.1% and 2.7%, respectively. The Industrial Select Sector SPDR ETF (XLI) acts as a trusty railcar, chugging along with a 0.3% pickup midday and a commendable 8.55% year-to-date increase. However, while Generac Holdings Inc faces a bumpy -9.64% ride year-to-date, United Airlines Holdings Inc soars with a 9.28% rise. Together, GNRC and UAL comprise about 0.6% of XLI’s holdings.

Monitoring the stock market sector by sector is akin to watching different performances in a grand theater. As the market plays out in the afternoon, five sectors take a bow for their upward movement, while three sectors quietly exit stage left.

| Sector | % Change |

|---|---|

| Materials | +0.6% |

| Industrial | +0.4% |

| Services | +0.3% |

| Financial | +0.2% |

| Consumer Products | +0.1% |

| Technology & Communications | 0.0% |

| Utilities | -0.1% |

| Energy | -0.1% |

| Healthcare | -0.7% |

![]() 25 Dividend Giants Widely Held By ETFs »

25 Dividend Giants Widely Held By ETFs »

Also see:

• CMRE Dividend History

• Funds Holding ERYY

• AFLAC RSI

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.