Industrial and Financial Sectors Lead Market Gains on Friday

As of midday Friday, Industrial companies are showing the strongest performance among market sectors, rising by 2.2%. Leading this sector are United Airlines Holdings Inc (Symbol: UAL) and Delta Air Lines Inc (Symbol: DAL), with impressive gains of 8.6% and 7.5%, respectively. The Industrial Select Sector SPDR ETF (Symbol: XLI), which tracks this sector, is also showing an increase of 2.1% for the day and is up 2.71% year-to-date. Meanwhile, United Airlines Holdings Inc has experienced a year-to-date decline of 22.67%, and Delta Air Lines Inc is down 26.03%. Together, UAL and DAL constitute approximately 1.3% of XLI’s underlying holdings.

The Financial sector is the next best performer, also rising by 2.1%. Notable large Financial stocks include Franklin Resources Inc (Symbol: BEN) and Discover Financial Services (Symbol: DFS), which are up by 6.8% and 4.8%, respectively. The Financial Select Sector SPDR ETF (XLF) is tracking this sector closely and is up 2.1% in midday trading, with a year-to-date increase of 3.32%. Franklin Resources Inc has seen a slight gain of 0.20% year-to-date, while Discover Financial Services is up 10.85%. Together, these two stocks make up approximately 0.8% of XLF’s underlying holdings.

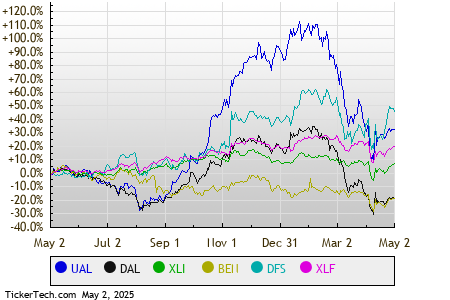

On a trailing twelve-month basis, a relative stock price performance chart is available, showing each of the symbols in distinct colors, as detailed in the legend at the bottom.

Here is a snapshot of how the S&P 500 components are performing across various sectors in afternoon trading on Friday. Notably, all nine sectors are up, reflecting a positive market environment.

| Sector | % Change |

|---|---|

| Industrial | +2.2% |

| Financial | +2.1% |

| Technology & Communications | +2.0% |

| Materials | +1.7% |

| Services | +1.6% |

| Energy | +1.5% |

| Healthcare | +1.3% |

| Consumer Products | +1.0% |

| Utilities | +0.6% |

![]() 25 Dividend Giants Widely Held By ETFs

25 Dividend Giants Widely Held By ETFs

Additional Information:

• RTRX Price Target

• DSWL Shares Outstanding History

• HRS Insider Buying

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.