Consumer Products Sector Faces Challenges Amid Mixed Market Performance

The Consumer Products sector is experiencing difficulties, showing a modest increase of only 0.4% as of midday Friday. Major contributors to this sector’s lag are Tesla Inc (Symbol: TSLA) and Smith (A O) Corp (Symbol: AOS), which are down 8.4% and 6.3%, respectively. In the realm of consumer product ETFs, the iShares U.S. Consumer Goods ETF (Symbol: IYK) has recorded a slight uptick of 0.5% today and is up 10.73% year-to-date. In contrast, Tesla Inc’s year-to-date performance has declined by 11.94%, while Smith (A O) Corp has seen a minor loss of 0.82% year-to-date.

Healthcare Sector Shows Some Resilience

Following closely behind is the Healthcare sector, which is up 0.5%. Here, notable stocks include Align Technology Inc (Symbol: ALGN) and Cardinal Health, Inc. (Symbol: CAH), which have decreased by 3.0% and 1.1%, respectively. The Health Care Select Sector SPDR ETF (XLV), which tracks this sector, is performing better with a rise of 0.6% in midday trading and boasts a 13.93% increase year-to-date. However, ALGN is down 18.66% year-to-date, whereas CAH has increased by 13.72% in the same timeframe. Together, these two stocks comprise about 0.8% of the XLV’s holdings.

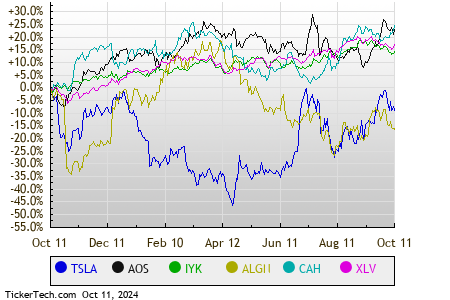

To compare performance further, the following chart illustrates the stock price trends for these companies and ETFs over the past twelve months:

Market Overview: S&P 500 Sectors in Focus

Here’s a quick snapshot of how various sectors within the S&P 500 are performing during Friday’s afternoon trading. Notably, all sectors are seeing gains, with nine sectors up on the day.

| Sector | % Change |

|---|---|

| Financial | +1.4% |

| Industrial | +1.2% |

| Services | +1.1% |

| Energy | +1.0% |

| Technology & Communications | +0.9% |

| Materials | +0.8% |

| Utilities | +0.7% |

| Healthcare | +0.5% |

| Consumer Products | +0.4% |

![]() 25 Dividend Giants Widely Held By ETFs »

25 Dividend Giants Widely Held By ETFs »

Also see:

• Top Ten Hedge Funds Holding NCBC

• Top Ten Hedge Funds Holding HCKT

• WRB Average Annual Return

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.