Market Trends Point to Opportunities in Advanced Micro Devices

Major US indexes are on a strong upward trajectory, as stocks enjoy a remarkable 2024, marking the third year of the current bull market.

Tech Stocks Propel Market Gains; Signs of Change Emerge

While technology stocks have primarily driven this rise, other areas of the market are starting to gain attention. Factors such as better-than-expected corporate earnings, easing inflation, and a favorable interest rate outlook are fueling this momentum.

Short-Term Risks May Signal Potential Short Opportunities

Despite this growth, many stocks seem overextended in the short run, providing few low-risk buying options for long investors. As we approach the New Year, there may be appealing short opportunities available.

Historically, December has been a strong month for the markets, but we often see mid-month weaknesses as institutions engage in tax-loss harvesting and profit-taking.

When searching for short positions, it’s crucial to focus on stocks that are already in or beginning to show downtrends. Companies that are lagging behind suggest limited overall buying pressure from the market.

AMD Faces Challenges Amid Industry Weakness

One company fitting this profile is Advanced Micro Devices (AMD). Despite the overall strength in the semiconductor sector, AMD’s shares have disappointed as major US indexes hit new highs. The stock’s characteristics indicate it could be a candidate for put option trades.

Advanced Micro Devices belongs to the Zacks Computer – Integrated Systems industry, which currently ranks in the bottom 46% of over 250 Zacks Ranked Industries. This ranking suggests that the group is likely to underperform the market in the next 3 to 6 months.

Research indicates that about half of a stock’s price changes are influenced by its industry. The top 50% of Zacks Ranked Industries outperform the bottom by more than two to one.

Recently, Bank of America downgraded AMD stock from Buy to Neutral, signaling concerns regarding its 2025 outlook. The bank reduced its price target from $180 per share to $155 per share and cut earnings per share (EPS) estimates for 2025 and 2026 by 6% and 8%, respectively.

Understanding Options: A Key to Strategic Trading

To explore trading strategies for AMD, it’s vital to understand some fundamental concepts about options. There’s no need for complex formulas; often simpler strategies yield better results over time.

Options are standardized contracts allowing the buyer the right, but not the obligation, to purchase or sell a stock at a predetermined price known as the strike price. A call option provides the right to buy, while a put option allows the right to sell. The individual purchasing the option is the buyer, while the one selling it is the seller or writer.

Options exist for a specific period, ending on their expiration date, with options available on weekly, monthly, and longer-term (LEAPS) bases. Each option possesses intrinsic and time value, with both factors influencing pricing.

How to Capitalize on a Decline in AMD Stock

AMD is currently moving downward and making lower lows, making it suitable for a put option purchase:

Image Source: StockCharts

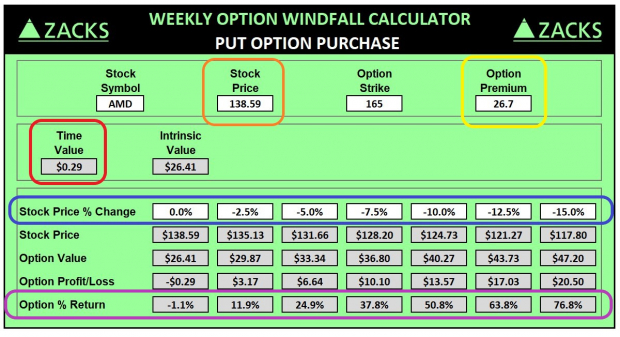

Properly executed, options trading offers significant profit potential with limited risk. For this analysis, we’ll focus on a put option that expires on January 17th, with a strike price of $165. This option allows us the ability to sell 100 shares of AMD at $165 by the expiration date, a little over a month from now.

The current stock price for AMD is $138.59 per share. We intend to buy a January 17 165-strike put at 26.7 points, costing us $2,670 total for the trade.

Image Source: Zacks Investment Research

The table indicates potential outcomes for AMD stock under various scenarios at expiration. If AMD remains static, our trade results in a slight loss of 1.1%. However, if the stock decreases by 5%, our profit rises to 24.9%. A 15% drop could yield a profit of 76.8%.

This example illustrates options’ leverage advantage. A trader shorting 100 shares of AMD would need to borrow $13,859 and faces unlimited risk. Conversely, the put option trader controls the same number of AMD shares for only $2,670, with a similar profit potential on a 15% price drop.

It’s also worth noting that this option features minimal time value, which means its value is primarily driven by intrinsic worth, an important consideration as options near expiration.

Conclusion: Navigating AMD’s Market Challenges

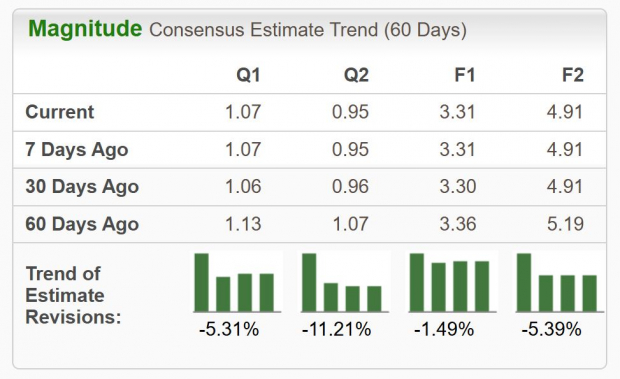

AMD stock continues to face headwinds, lagging behind broader market gains while coping with declining earnings estimates. Our findings show that these revisions significantly impact stock prices.

Considering a decline in AMD, low-risk put options present a promising strategy. This approach offers investors a way to harness possible downward movement with the advantages that options trading provides.

Explore Nuclear Energy’s Promising Future

As electricity demand surges, the shift from fossil fuels like oil and gas is accelerating. Nuclear energy has emerged as a viable alternative.

Recently, leaders from the US and 21 other nations pledged to triple the world’s nuclear energy capacities, signaling a major shift that could bring substantial opportunities for nuclear-related stocks and early investors.

Our urgent report, Atomic Opportunity: Nuclear Energy’s Comeback, outlines the key players and innovations driving this trend, spotlighting three stocks positioned to benefit significantly.

Download the report, Atomic Opportunity: Nuclear Energy’s Comeback, for free today.

For the latest updates and recommendations from Zacks Investment Research, you can download 5 Stocks Set to Double.

Further analysis on Advanced Micro Devices, Inc. (AMD) is available in our free stock analysis report.

To read more about this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein belong to the author and are not necessarily those of Nasdaq, Inc.