“`html

Wells Fargo initiated coverage of Marathon Petroleum (NYSE:MPC) with an “Overweight” recommendation on October 17, 2025. The average one-year price target for Marathon Petroleum is $194.24/share, suggesting a 5.30% upside from its latest closing price of $184.47/share.

Marathon Petroleum’s projected annual revenue is $102.025 billion, a decrease of 23.78%. Institutional ownership saw an increase of 1.03%, with 2,454 funds reporting positions. The total shares owned by institutions decreased by 0.62% to 267.42 million shares.

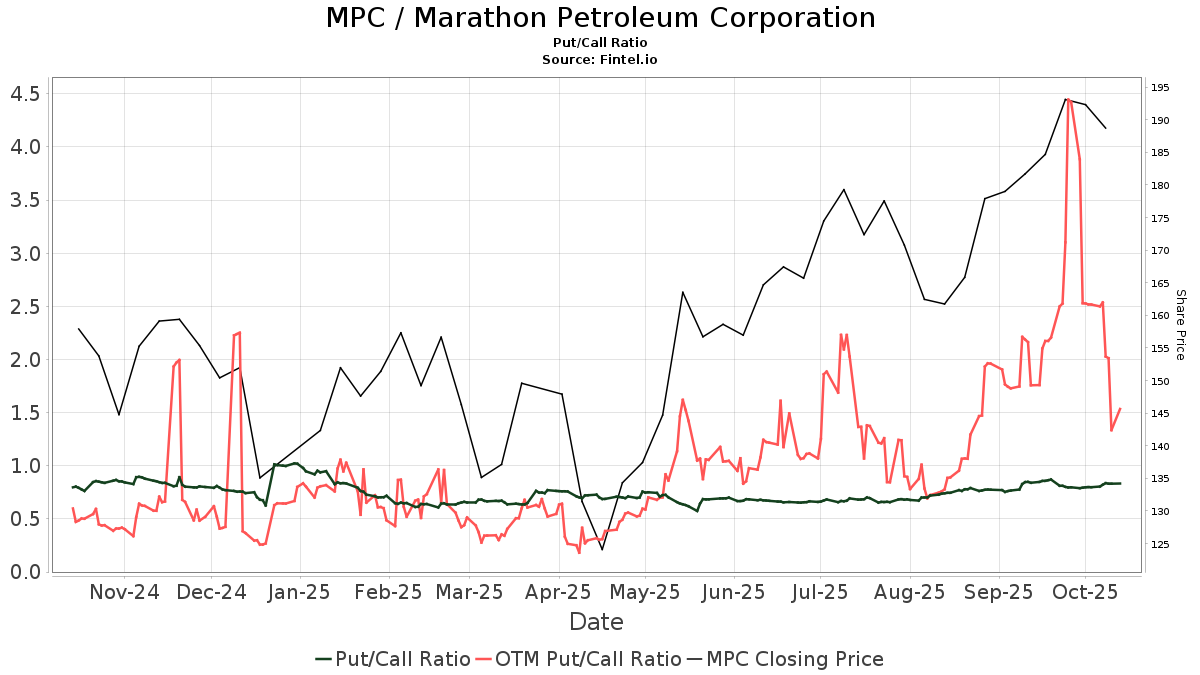

The put/call ratio for MPC is 0.86, indicating a bullish outlook. Notable institutional shareholders include Wellington Management Group (3.84% ownership, 1.26% decrease), Vanguard Total Stock Market Index Fund (3.25% ownership, slight increase), and Geode Capital Management (2.64% ownership, 12.90% increase).

“`