“`html

Wells Fargo initiated coverage of Wyndham Hotels & Resorts (NYSE:WH) with an Equal-Weight recommendation on December 5, 2024. The average one-year price target is set at $101.20 per share, indicating a potential downside of 0.72% from the latest closing price of $101.93.

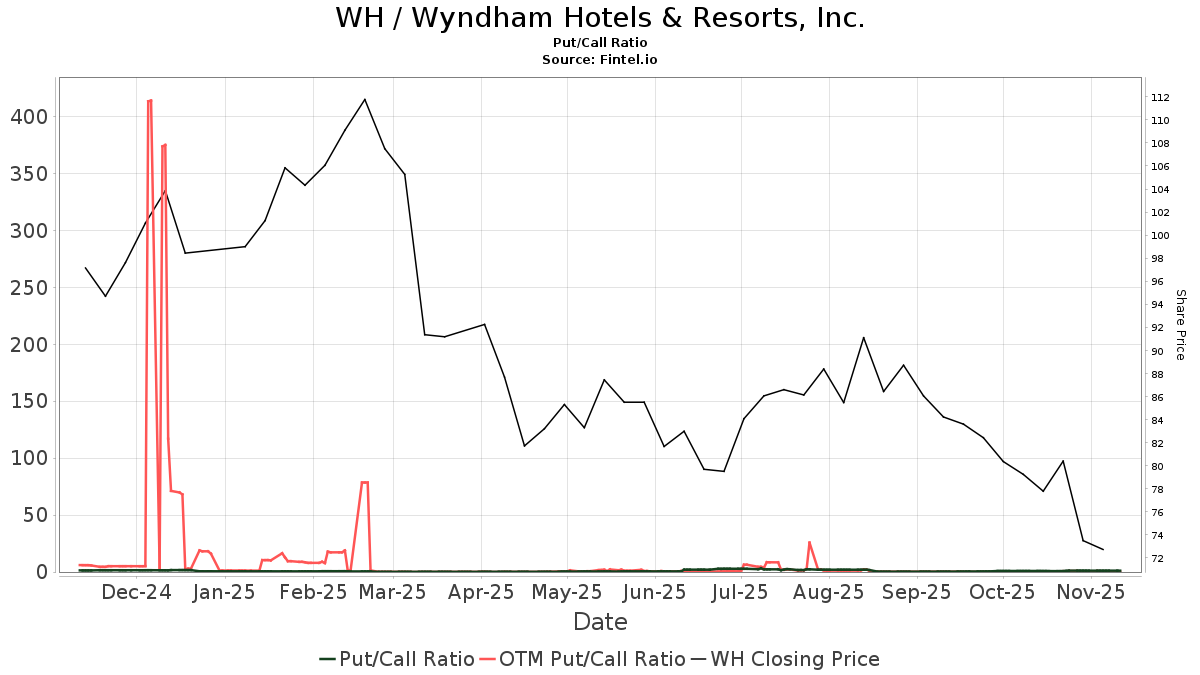

The projected annual revenue for Wyndham Hotels is $1.578 billion, reflecting a 14.10% increase. Currently, 880 funds or institutions hold positions in Wyndham, with a total of 103.286 million shares owned, marking a 4.86% increase over the last three months. The put/call ratio stands at 1.57, suggesting a bearish outlook.

Capital Research Global Investors has increased its stake from 9.197 million to 9.484 million shares, now holding 12.19% of the company. Conversely, Wellington Management Group has decreased its allocation from 6.161 million to 5.785 million shares, reducing its ownership by 6.49%.

“`