Wells Fargo Initiates Coverage of HEICO with Equal-Weight Rating

On April 15, 2025, Wells Fargo commenced coverage of HEICO (LSE:0J46) with an Equal-Weight recommendation.

Analyst Price Forecast Indicates Potential Growth

As of April 2, 2025, analysts have set an average one-year price target for HEICO at 279.20 GBX per share. These forecasts vary, with estimates ranging from a low of 217.42 GBX to a high of 329.78 GBX. This average target reflects a potential increase of 12.34% from HEICO’s latest closing price of 248.52 GBX per share.

Visit our leaderboard for companies showing substantial price target upside.

Projected Revenue and Earnings

The anticipated annual revenue for HEICO is 3,043 million GBX, indicating a decrease of 23.76%. The projected annual non-GAAP EPS stands at 3.86.

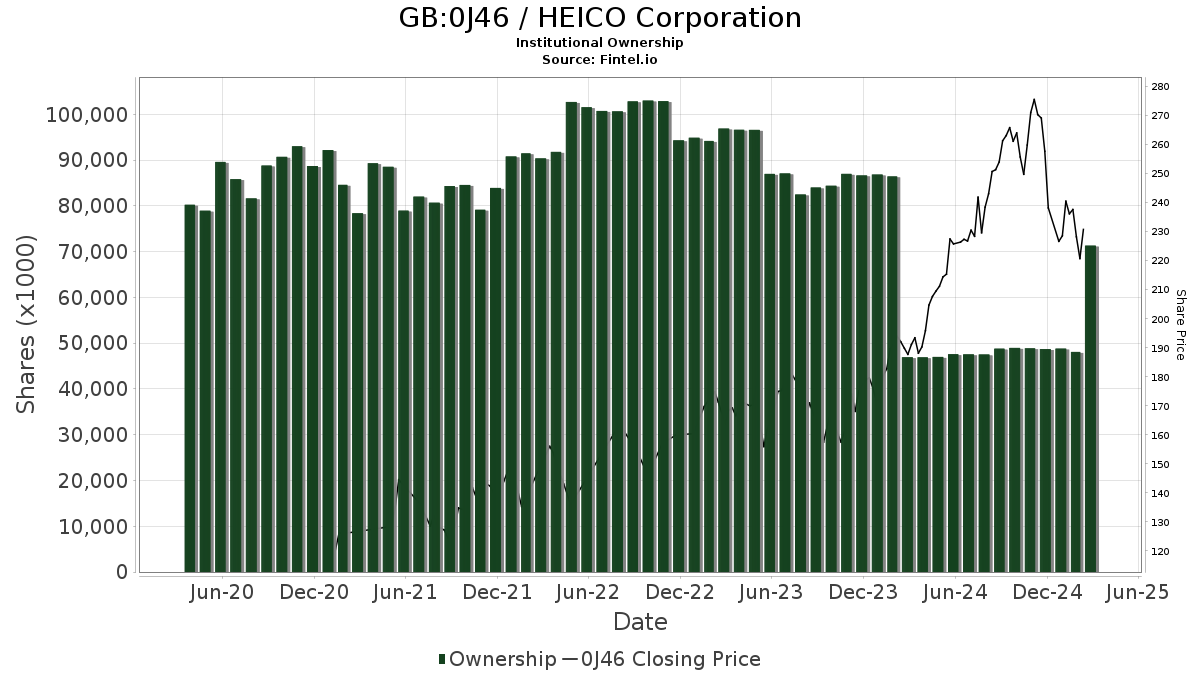

Institutional Fund Sentiment

Currently, 990 funds and institutions hold positions in HEICO, reflecting an increase of 15 owners or 1.54% over the last quarter. The average portfolio weight for all funds dedicated to 0J46 is now 0.28%, a rise of 8.43%. Over the past three months, total shares owned by institutions have increased by 0.80% to 48,950K shares.

Shareholder Movements

Capital World Investors now holds 4,895K shares, representing 8.90% ownership of the company. This is an increase from its previous filing of 3,934K shares, reflecting a significant rise of 19.63%. The firm’s portfolio allocation in 0J46 increased by 10.78% over the last quarter.

In contrast, AGTHX – GROWTH FUND OF AMERICA now holds 1,783K shares, which accounts for 3.24% ownership, down from 1,888K shares, a decrease of 5.87%. The firm reduced its allocation to 0J46 by 6.43% recently.

No changes were reported for ANWPX – NEW PERSPECTIVE FUND, which maintains 1,633K shares, or 2.97% of the company.

Lazard Asset Management holds 1,083K shares, or 1.97% ownership, down from 1,263K shares—signifying a decline of 16.61% in its allocation to 0J46. Similarly, CMGIX – Blackrock Mid Cap Growth Equity Portfolio Institutional decreased its holdings to 1,051K shares, accounting for 1.91% ownership, a drop of 32.26% since its last filing, representing a 22.08% reduction in its allocation.

Fintel is recognized as a comprehensive investment research platform, providing essential data to individual investors, traders, financial advisors, and small hedge funds.

Our extensive database covers a wide array of fundamentals, analyst reports, ownership statistics, fund sentiment, insider trading, and options activity, among other insights. Additionally, our proprietary Stock picks are derived from advanced, backtested quantitative models aimed at optimizing profits.

Click to Learn More

This story initially appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.