Wells Fargo Begins Coverage of Unity Software with Positive Outlook

On October 28, 2024, Wells Fargo officially started tracking Unity Software (NYSE:U) with an Equal-Weight rating.

Analyst Price Target Indicates Room for Growth

The average price target for Unity Software, as of October 22, 2024, stands at $21.52 per share. This figure shows a potential increase of 4.88% from Unity’s recent closing price of $20.52 per share. Analyst predictions vary, with a low estimate of $10.10 and a high of $42.00.

For a comprehensive view, check out our leaderboard showcasing companies with the highest price target upside.

Projected Growth and Financial Insights

Unity Software is expected to generate annual revenue of $2,722 million, reflecting an impressive 31.94% growth. Additionally, the projected non-GAAP Earnings Per Share (EPS) is forecasted to be 0.76.

Trends in Fund Ownership

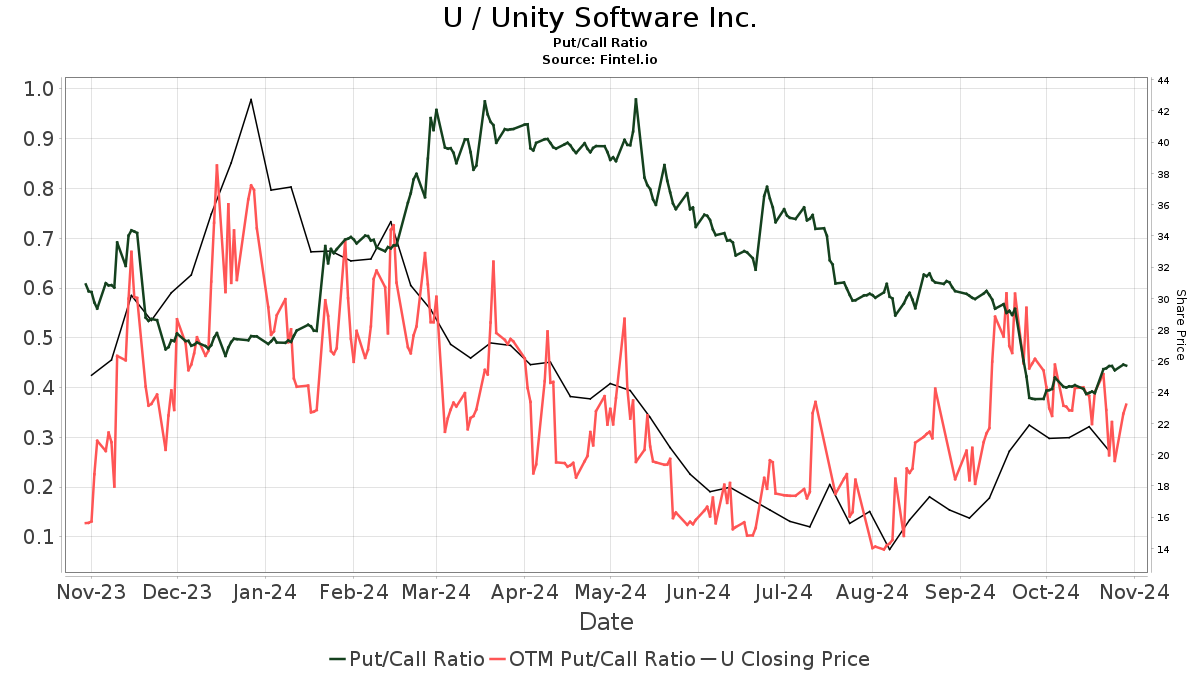

A total of 745 investment funds hold positions in Unity Software. Recently, this number decreased by 50 funds, or 6.29%. The average portfolio weight for all funds invested in Unity is now 0.22%, which marks a 27.31% increase. Furthermore, institutional ownership has rose by 2.66% over the past three months, totaling 327,275,000 shares.  The current put/call ratio for Unity stands at 0.45, suggesting a bullish market sentiment.

The current put/call ratio for Unity stands at 0.45, suggesting a bullish market sentiment.

Activities of Major Shareholders

Silver Lake Group, L.L.C. remains a significant player, holding 34,735,000 shares, constituting 8.75% of the company, unchanged from the previous quarter.

Meanwhile, Sc Us has increased its ownership from 28,576,000 shares (7.43%) to 32,250,000 shares, reflecting an 11.39% growth, despite reducing its overall investment in Unity by 43.24% recently.

The AGTHX – Growth Fund of America increased its stake to 17,523,000 shares for 4.42% ownership, up 18.09% from the last report. In contrast, Resolute Advisors has reduced its position from 14,640,000 shares to 14,243,000 shares, marking a decline of 2.79%. Lastly, the Norges Bank made a notable entry by acquiring 11,871,000 shares after previously not holding any, which is a 100% increase.

Understanding Unity Software

Unity Software, Inc. is recognized as the premier platform for creating and managing real-time 3D (RT3D) content. Its tools cater to a diverse group of creators, including game developers, artists, architects, automotive designers, and filmmakers. The platform has proven crucial in transforming creative ideas into interactive experiences across mobile devices, PCs, consoles, and virtual/augmented reality applications. With more than 1,800 professionals in research and development, Unity consistently adapts to industry changes, ensuring support for the latest technology. In 2020 alone, apps developed on the Unity platform amassed over five billion downloads monthly.

Fintel serves as a leading investment research platform, providing valuable data and insights, including fundamentals, analyst reports, and fund sentiment.

This article originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.