Wells Fargo Upgrades Affirm Holdings: What Investors Should Know

On October 11, 2024, Wells Fargo changed their rating for Affirm Holdings (NasdaqGS:AFRM) from Equal-Weight to Overweight.

Analysts Predict a Drop in Affirm’s Stock Price

As of September 25, 2024, analysts set an average one-year price target for Affirm Holdings at $40.72 per share. The estimates range from a low of $20.20 to a high of $68.25. Notably, this average price target reflects a potential decline of 13.52% from the latest closing price of $47.08 per share.

Projected Revenue and Earnings

Affirm Holdings is expected to generate $2.741 billion in annual revenue, indicating a growth rate of 17.99%. However, the projected annual non-GAAP earnings per share (EPS) stands at -$1.97.

Fund Sentiment Overview

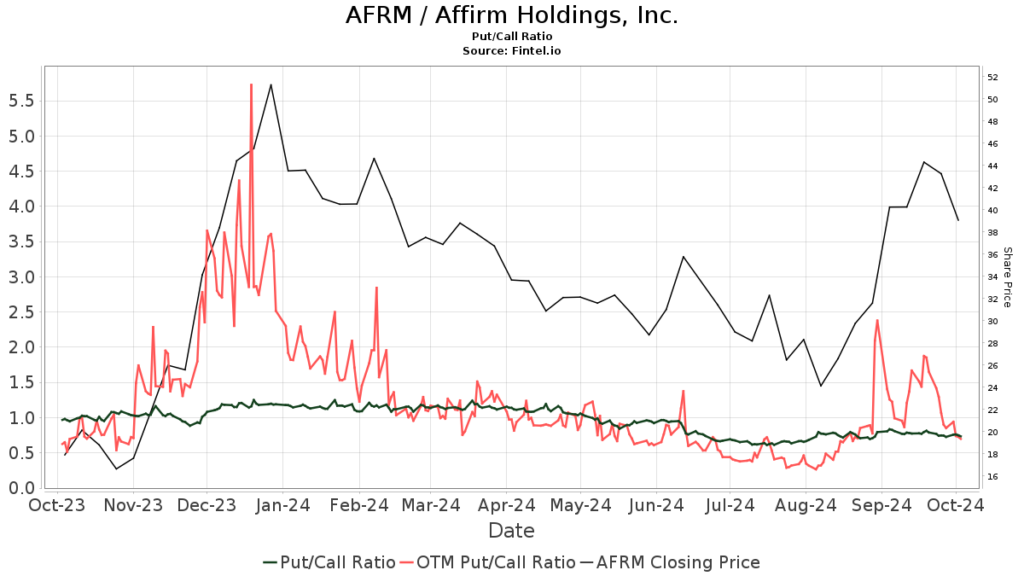

A total of 651 funds or institutions are currently invested in Affirm Holdings, marking a decrease of 18 owners, or 2.69%, compared to the previous quarter. The average portfolio weight allocated to AFRM by these funds is at 0.38%, a slight increase of 2.22%. Institutional ownership saw a minor decline of 0.15% over the last three months, with total shares held dropping to 250,463K shares.  The put/call ratio for AFRM is currently 0.74, suggesting a generally bullish market outlook.

The put/call ratio for AFRM is currently 0.74, suggesting a generally bullish market outlook.

Recent Moves by Major Shareholders

Capital Research Global Investors holds 23,759K shares, reflecting an 8.88% stake in the company. This represents an increase of 18.26% from their previous holding of 19,420K shares, although their overall portfolio allocation to AFRM decreased by 3.80% last quarter.

Meanwhile, AGTHX – Growth Fund of America owns 20,092K shares, translating to 7.51% ownership. This is a slight decline of 2.34% from the prior holding of 20,562K shares, and they reduced their portfolio allocation in AFRM by 24.26% in the last quarter.

Capital World Investors holds 18,808K shares for 7.03% ownership, down from 19,079K shares previously, indicating a decrease of 1.44%. Their allocation decreased by 21.25% in the last quarter.

Baillie Gifford has significantly reduced its stake, holding now 13,400K shares (5.01% ownership), down from 18,732K shares, marking a 39.79% drop and a 77.39% reduction in portfolio allocation.

D. E. Shaw reported holding 7,539K shares, or 2.82% ownership, which is a decrease of 20.33% from their previous 9,072K shares, reflecting a 43.83% reduction in their allocation to AFRM.

Affirm Holdings: Company Overview

(This description is provided by the company.) Affirm’s mission is to provide transparent financial products that enhance customers’ lives. The company is developing a next-generation platform for digital and mobile commerce, facilitating responsible consumer spending while helping merchants increase sales and fostering growth in the commerce sector.

Fintel stands out as a robust investment research platform that caters to individual investors, traders, and small hedge funds. Our data encompasses a wide range of investment research tools, including fundamentals, analyst reports, ownership data, and fund sentiment, delivering insights for optimal decision-making.

Click to Learn More

This article originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.