Wells Fargo Upgrades Molson Coors: Positive Outlook for Investors

Fintel reports that on November 8, 2024, Wells Fargo upgraded their outlook for Molson Coors Beverage (NYSE:TAP) from Underweight to Overweight.

Price Targets Indicate Moderate Growth Potential

As of October 22, 2024, the average one-year price target for Molson Coors Beverage stands at $61.25 per share. This forecast reflects a range from a low of $47.47 to a high of $78.75. The average price target suggests a potential upside of 2.84% based on the latest reported closing price of $59.56 per share.

Check out our leaderboard showcasing companies with the highest price target upside.

Revenue Projections and Earnings Outlook

The projected annual revenue for Molson Coors Beverage is $11,144 million, marking a decline of 4.61%. Meanwhile, the anticipated annual non-GAAP EPS is estimated at $4.42.

Institutional Investor Sentiment

Currently, 1,335 funds or institutions hold positions in Molson Coors Beverage. This indicates a slight decline of 6 investors, or 0.45%, over the last quarter. Notably, the average portfolio weight for all funds invested in TAP has increased by 8.01% to 0.20%. In terms of shares, institutional ownership has risen by 1.04% in the past three months, totaling 208,946K shares.

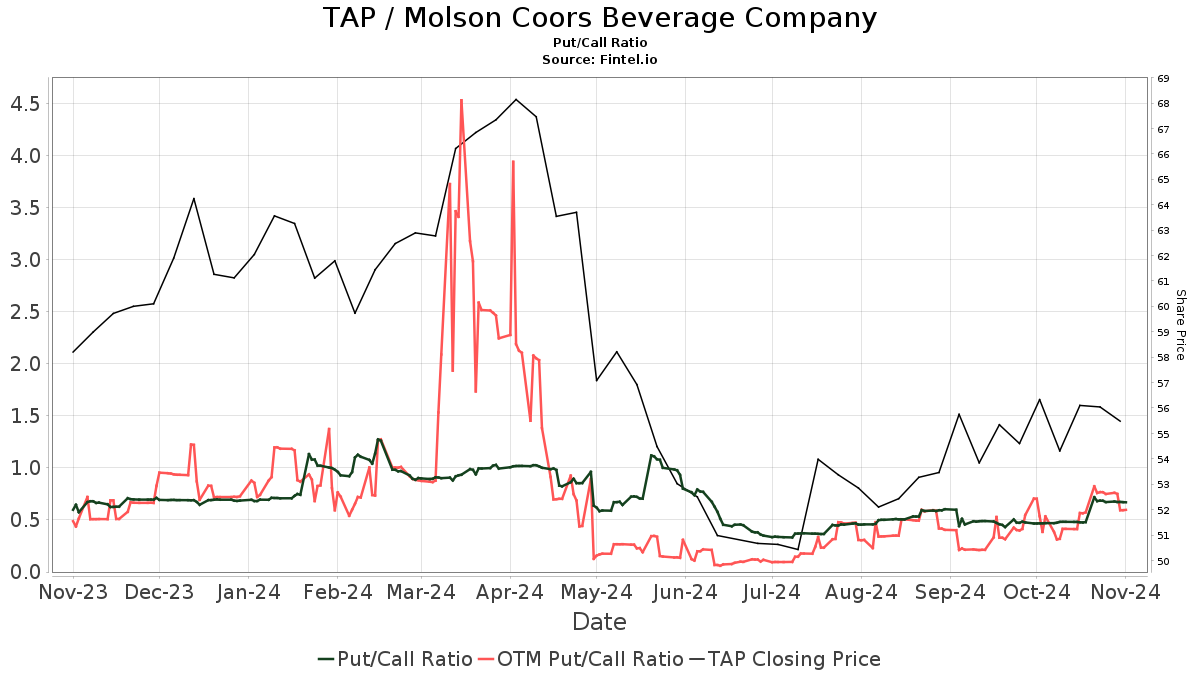

The put/call ratio for TAP is 0.62, which indicates a generally optimistic market sentiment.

Shareholder Activities and Changes

Dodge & Cox holds 14,575K shares, representing 7.57% ownership of Molson Coors. Their last filing showed an increase of 60K shares, a rise of 0.41%. However, they have reduced their overall portfolio allocation in TAP by 21.48% in the past quarter.

The DODGX – Dodge & Cox Stock Fund maintains 10,727K shares, accounting for 5.57% ownership, reflecting no change from their previous position.

Lsv Asset Management owns 6,306K shares, which is 3.27% of the company. This reflects a slight decrease of 0.40% from the previous quarter, with a portfolio allocation reduction of 20.29%.

The Vanguard Total Stock Market Index Fund (VTSMX) holds 5,635K shares, representing 2.93% ownership, which is a slight increase of 0.91%. However, they decreased their allocation in TAP by 25.82% over the last quarter.

The Pacer US Cash Cows 100 ETF (COWZ) significantly increased its stake, holding 5,475K shares or 2.84% ownership, up from 3,430K shares, indicating a remarkable 37.35% increase in their portfolio allocation.

About Molson Coors Beverage

(This description is provided by the company.)

For over 200 years, Molson Coors has crafted beverages that bring people together. Its extensive portfolio includes well-known brands like Coors Light, Miller Lite, and Blue Moon, as well as various innovative options beyond traditional beer. The company is committed to setting high industry standards and has set sustainability goals for 2025, aiming to positively impact employees, consumers, and the environment.

Fintel serves as a robust investment research platform tailored for individual investors, traders, financial advisors, and small hedge funds.

Our data provides comprehensive insights into fundamentals, analyst reports, ownership trends, and much more. Additionally, our stock picks leverage advanced, backtested quantitative models for optimized investment outcomes.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.