“`html

On October 31, 2025, Wells Fargo maintained an Overweight rating for Amazon.com (NasdaqGS:AMZN), suggesting an average one-year price target of $272.31 per share. This represents an anticipated increase of 11.50% from its latest closing price of $244.22 per share on October 30, 2025.

Amazon’s projected annual revenue is estimated at $693.815 billion, with a non-GAAP EPS of 7.79. As of now, 7,738 funds hold positions in Amazon, marking a 1.96% increase from the previous quarter. Total shares owned by institutions rose by 2.45% to 7,881,761,000 shares.

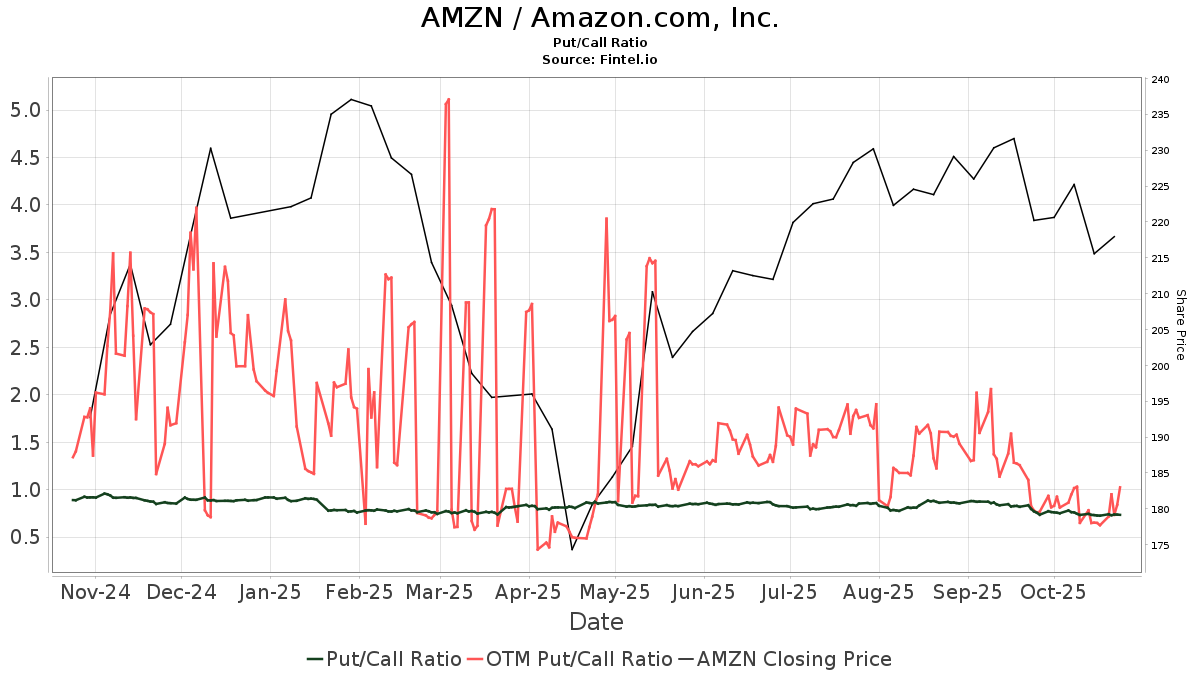

The put/call ratio for Amazon is currently at 0.69, indicating a bullish sentiment, while notable institutional movements include Vanguard Total Stock Market Index Fund increasing its stake to 307,246,000 shares, a 1.93% rise, and J.P. Morgan Chase reducing its holdings to 192,800,000 shares, a decrease of 3.85%.

“`