Wells Fargo Raises Sinclair’s Outlook: A Positive Shift for Investors

Analyst Forecast Indicates Modest Growth Ahead

On November 7, 2024, Wells Fargo upgraded its outlook for Sinclair (NasdaqGS:SBGI) from Underweight to Equal-Weight. This change signals a shift in sentiment towards Sinclair’s stock, pointing to potential stability.

As of October 22, 2024, the average one-year price target for Sinclair stands at $17.34 per share, with predictions ranging from $11.62 at the low end to $31.50 at the high end. This average target suggests a 2.42% increase from the most recent closing price of $16.93 per share.

Explore our leaderboard to see companies with the largest potential price target upsides.

The anticipated annual revenue for Sinclair is projected at $3.92 billion, representing a significant increase of 16.35%. The expected annual non-GAAP EPS is calculated at 3.56.

How Are Institutional Investors Reacting?

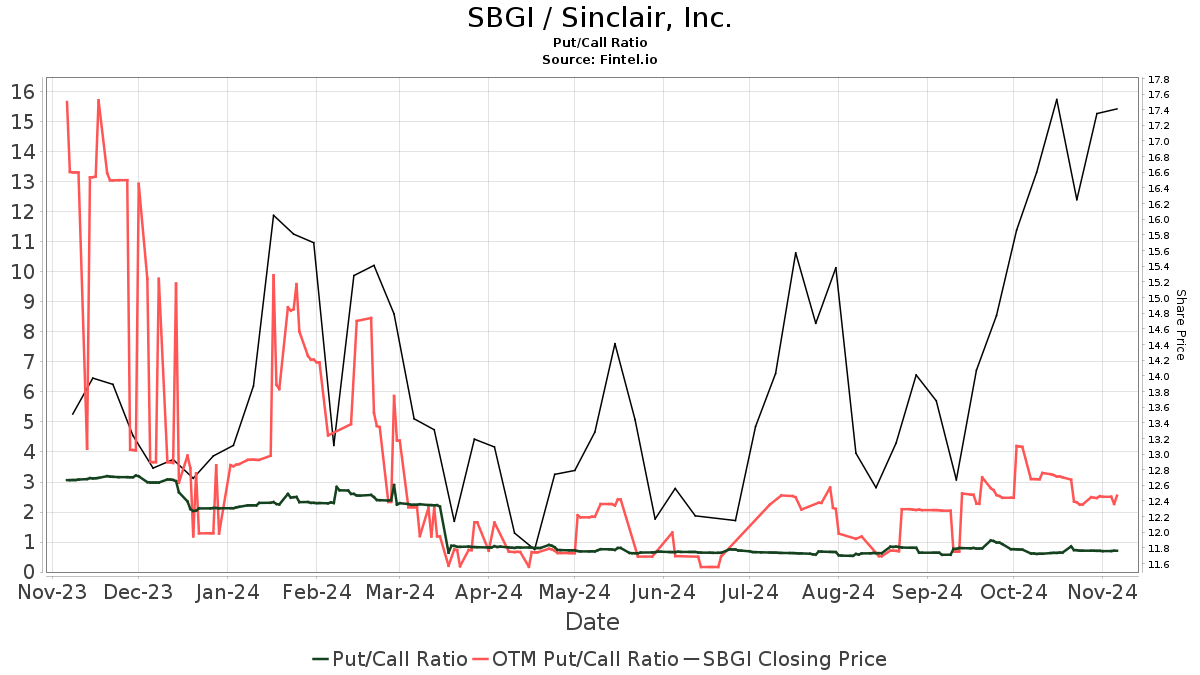

Recently, 360 funds and institutions have reported positions in Sinclair, which reflects a decrease of 10 owners, or about 2.70%, from the previous quarter. The average portfolio weight for all funds focused on SBGI is now 0.12%, showing an increase of 16.55%. Institutional ownership has also risen, with total shares owned climbing by 0.17% to reach 31.05 million shares.  Currently, the put/call ratio for SBGI is 0.70, suggesting a more optimistic outlook among investors.

Currently, the put/call ratio for SBGI is 0.70, suggesting a more optimistic outlook among investors.

Recent Movements by Shareholders

Gamco Investors, Inc. Et Al now holds 3.63 million shares, representing 8.51% ownership. This is an increase from 3.59 million shares, marking a 0.92% rise in their holdings. The firm also boosted its portfolio allocation in SBGI by 7.39% over the last quarter.

Meanwhile, Capital Management’s position stands at 1.73 million shares, constituting a 4.07% ownership. The firm reported a slight reduction from its prior 1.76 million shares, indicating a decrease of 1.49%, although they increased their allocation in SBGI by 0.28% in the last quarter.

Alden Global Capital has ramped up its stake, holding 1.23 million shares, or 2.88%, an increase of 9.47% from its previous holding of 1.11 million shares, with a notable 23.69% increase in portfolio allocation in the last quarter.

Gabelli Funds reported an increase to 1.21 million shares, equating to 2.84% ownership, from 1.19 million shares, which is a 1.71% rise. Their allocation in SBGI also grew by 3.81% in the past quarter.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares increased its holdings to 1.02 million shares, representing 2.39%. The firm previously held 956,000 shares, marking a 6.21% increase, with a 2.61% rise in their portfolio allocation in SBGI over the last quarter.

About Sinclair Broadcast Group

(Company-provided description)

Sinclair Broadcast Group, Inc. operates as a diversified media company and a key provider of local sports and news. The company owns or operates 23 regional sports networks and manages 190 television stations across 88 markets. Sinclair is a major source of local news in the U.S., has several national channels, and partners with all major broadcast networks. Its content is accessible through various platforms, including over-the-air broadcasts and digital channels. Additionally, Sinclair engages in equity investments in strategic enterprises through its ventures and subsidiaries.

Fintel is a comprehensive research platform designed for individual investors, traders, financial advisors, and small hedge funds.

Our data encompasses global fundamentals, analyst reports, ownership statistics, fund sentiment, insider trading, and options activity. We also provide exclusive stock selections powered by advanced quantitative models for enhanced profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.