Wells Fargo Downgrades Packaging Corporation Outlook to Equal-Weight

Fintel reports that on May 9, 2025, Wells Fargo downgraded their outlook for Packaging Corporation of America (LSE:0KEZ) from Overweight to Equal-Weight.

Analyst Price Forecast Indicates Significant Upside Potential

As of May 7, 2025, analysts project a one-year average price target for Packaging Corporation of America at 219.13 GBX/share. The estimates vary from a low of 152.25 GBX to a high of 261.41 GBX. This average price target implies a 19.32% increase from the most recent closing price of 183.65 GBX/share.

Projected Revenue and Earnings

Packaging Corporation of America is expected to generate an annual revenue of 8,550 million, reflecting a slight increase of 0.06%. Additionally, the projected annual non-GAAP earnings per share (EPS) sit at 9.54.

Fund Sentiment Overview

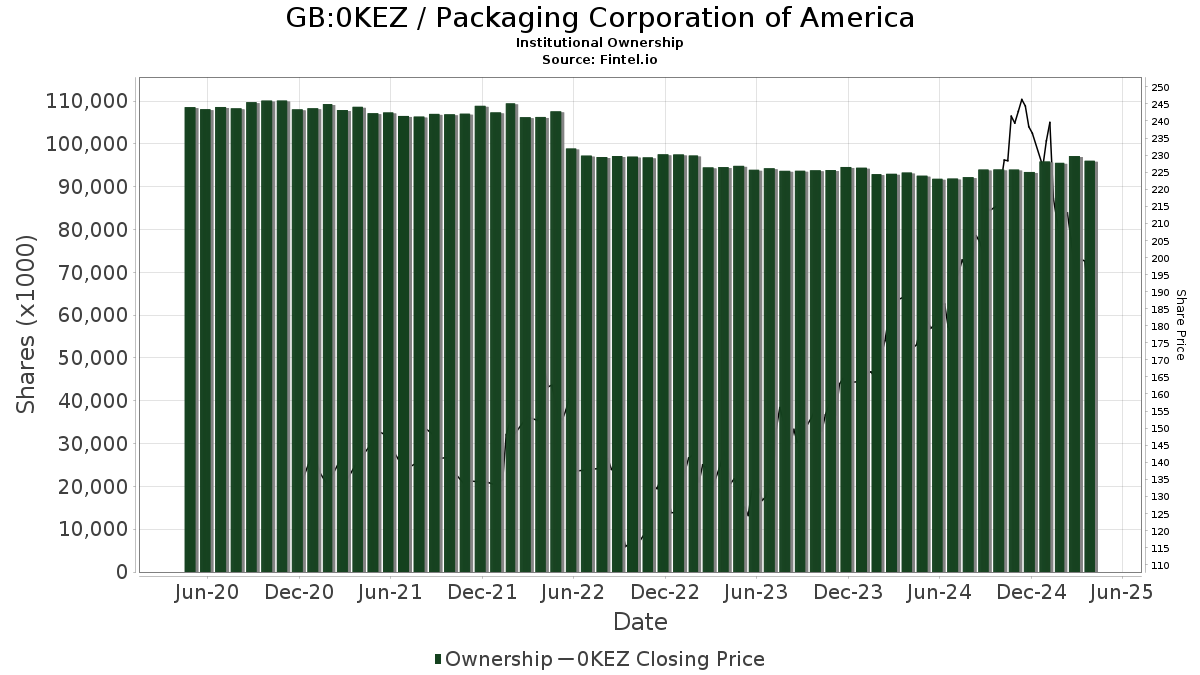

A total of 1,641 funds or institutions currently hold positions in Packaging Corporation of America, marking an increase of 66 owners (4.19%) in the last quarter. The average portfolio weight of all funds dedicated to 0KEZ stands at 0.22%, up by 6.43%. However, total shares owned by institutions have decreased by 1.23% over the last three months to 94,989,000 shares.

Shareholder Activity

Among the notable shareholders, Charles Schwab Investment Management holds 3,273,000 shares, amounting to 3.64% ownership of the company. Previously, it reported ownership of 3,070,000 shares, representing a 6.20% increase. However, the firm decreased its portfolio allocation in 0KEZ by 24.76% over the last quarter.

Vanguard Total Stock Market Index Fund (VTSMX) owns 2,804,000 shares, reflecting 3.12% ownership. This is a decrease from the prior 2,844,000 shares, down by 1.43%, although the firm’s portfolio allocation in 0KEZ increased by 1.55% in the same period.

Vanguard 500 Index Fund (VFINX) holds 2,413,000 shares, representing 2.68% ownership. Previously, it reported 2,335,000 shares, showing a 3.24% increase, with a 2.19% rise in portfolio allocation in 0KEZ over the last quarter.

Geode Capital Management possesses 2,367,000 shares, which is 2.63% of the company. This is an increase from the previous holdings of 2,337,000 shares, despite a 46.65% decrease in portfolio allocation in 0KEZ.

The Schwab U.S. Dividend Equity ETF (SCHD) holds 2,347,000 shares, representing 2.61% ownership, up from 2,265,000 shares—an increase of 3.53%. However, the firm has reduced its portfolio allocation in 0KEZ by 14.19% over the last quarter.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.