Wells Fargo Downgrades Regeneron Pharmaceuticals Outlook

On May 30, 2025, Wells Fargo downgraded their rating for Regeneron Pharmaceuticals (LSE:0R2M) from Overweight to Equal-Weight.

Current Fund Sentiment

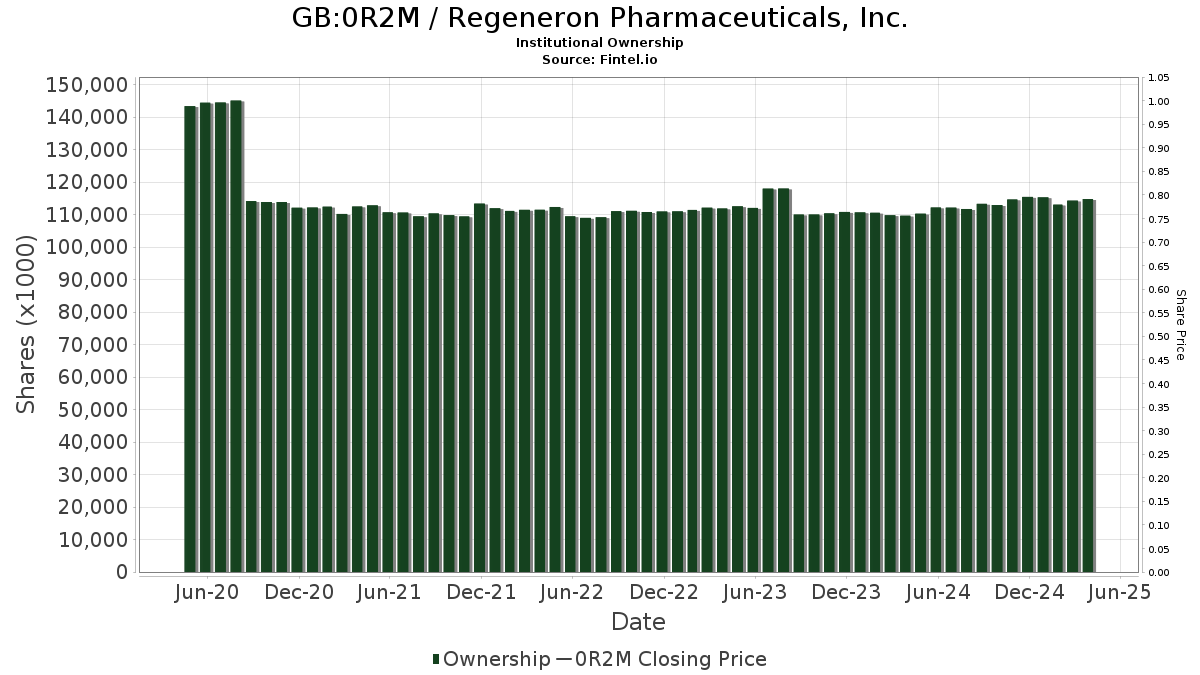

A total of 2,377 funds report positions in Regeneron Pharmaceuticals, reflecting a decline of 81 funds, or 3.30%, from the previous quarter. The average portfolio weight of all funds in 0R2M rose by 1.74% to 0.35%. Institutional ownership decreased by 0.93% in the last three months, totaling 113,247K shares.

Shareholder Actions

JPMorgan Chase holds 5,658K shares, representing 5.45% ownership, down from 7,059K shares, a decrease of 24.76%. Their allocation in 0R2M fell by 92.61% last quarter.

Capital International Investors has 3,989K shares, indicating 3.84% ownership. They reported a decline from 4,737K shares, an 18.75% drop, reducing their allocation in 0R2M by 21.50% last quarter.

The Vanguard Total Stock Market Index Fund (VTSMX) owns 3,396K shares, or 3.27% ownership. This is a slight increase from 3,387K shares, a 0.26% rise, although their allocation in 0R2M decreased by 6.87% over the last quarter.

The Vanguard 500 Index Fund (VFINX) holds 2,922K shares (2.81% ownership), up from 2,849K shares, an increase of 2.51%. Their overall allocation in 0R2M also dropped by 6.75% last quarter.

Geode Capital Management now has 2,470K shares for 2.38% ownership. They previously held 2,428K shares, an increase of 1.70%, though their portfolio allocation decreased by 51.47% in the last quarter.