Wells Fargo Lowers Outlook for United Therapeutics Amid Fund Changes

Fintel reports that on April 25, 2025, Wells Fargo downgraded its outlook for United Therapeutics (BMV: UTHR) from Overweight to Equal-Weight.

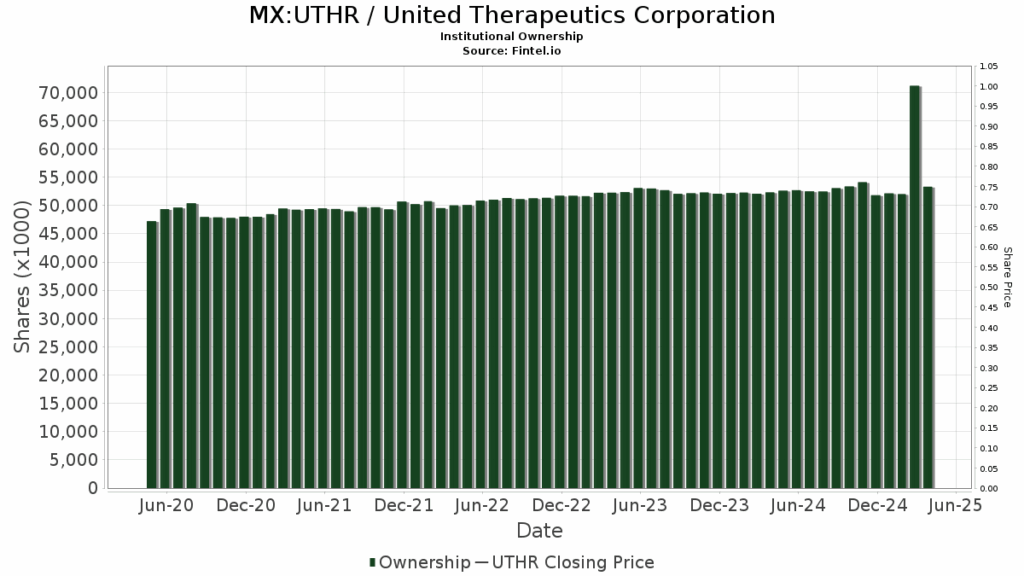

Institutional Fund Sentiment

Currently, 860 funds or institutions hold positions in United Therapeutics, reflecting an increase of 7 owners or 0.82% in the last quarter. The average portfolio weight dedicated to UTHR across all funds is 0.28%, marking an increase of 0.09%. Total shares owned by institutions rose by 0.22% over the last three months, reaching 47,958K shares.

Changes Among Major Shareholders

Avoro Capital Advisors holds 2,760K shares, equating to 6.15% ownership of United Therapeutics. In its previous filing, the firm reported 2,859K shares, indicating a decrease of 3.57%. This shift reflects a 7.78% reduction in allocation to UTHR over the last quarter.

Wellington Management Group LLP owns 2,464K shares, translating to 5.49% ownership. The firm reported 3,171K shares in its prior filing, which corresponds to a decrease of 28.69%. Consequently, Wellington decreased its portfolio allocation in UTHR by 88.80% in the last quarter.

Renaissance Technologies holds 2,089K shares, representing 4.65% ownership. The firm previously reported 2,155K shares, revealing a decrease of 3.16%. Their portfolio allocation in UTHR was reduced by 6.05% in the last quarter.

The IJH – iShares Core S&P Mid-Cap ETF owns 1,449K shares, accounting for 3.23% ownership. In the most recent filing, it reported 1,391K shares, marking an increase of 4.03%. However, the ETF reduced its allocation in UTHR by 1.47% over the last quarter.

The VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 1,400K shares, which represents 3.12% ownership. The previous report indicated ownership of 1,410K shares, thus marking a decrease of 0.66%. This fund also reduced its allocation in UTHR by 3.60% in the last quarter.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.